These Joyful Delights Have Joyful Ends — NGMI Newsletter #11

tokenized private companies, a hidden alt season, the future of futures, robinhood vs coinbase, solana capital markets, NGMI Capital goes airdrop farming & more

We’re just 10 hours into July, and the theme of this month appears to be tokenizing equities and slapping them on the blockchain.

In a debonair keynote in the French Riviera, Robinhood CEO Vlad Tenev introduced tokenized stocks on his platform, which will give EU users access to more than 200 tokenized versions of US stocks.

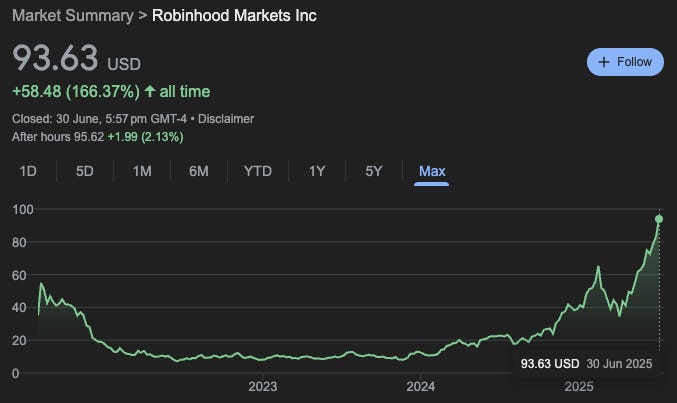

Robinhood (HOOD) stock rallied to a fresh all-time high of $94 on the news.

This is one of the first times that the idea of “tokenized” assets has broken through into the retail market, and it’s a reasonable proof of concept that blockchain tech is very much positioned as the future plumbing of the financial world.

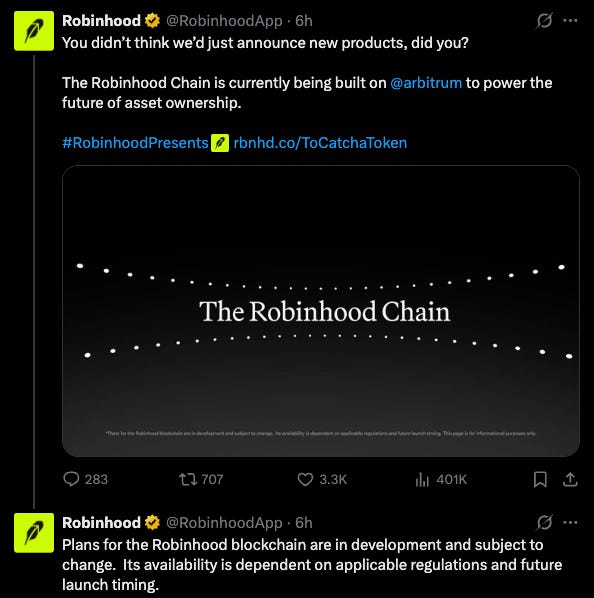

More than that, Robinhood also announced the launch of Robinhood Chain, its own enterprise network built on the Ethereum L2 Arbitrum.

You’ll notice that Robinhood included a nice little disclaimer there, conveniently caveating: “Plans for the Robinhood blockchain are in development and subject to change.”

While the Robinhood chain may be built on the Arbitrum tech stack, this will very much be their own enterprise network that allows them to scoop up fees and control network activity. I would not be surprised if they exert much greater control over this in the future.

While this is a cool and novel development that introduces the crypto industry as a serious contender to start increasing its market share in the TradFi world, Robinhood has unknowingly unlocked the gates of private enterprise blockchain hell.

In the main HQ of every single financial services company in the United States, a product manager is pacing up and down, asking his team:

"Guys, why don't we launch our own blockchain? no, but like seriously guys - let me hear the objections first."

The timeline will soon be awash with ETH maxis furiously masturbating over which irrelevant fintech company chooses their L2 to build on. If they choose to build on ETH, every fintech company will offer some privatized L2 so they can cabal fee revenue and network activity, with absolutely zero value added to native ETH.

SOL maxis will fall in a similar boat, but will be less insufferable because at least value will accrue to the mainnet at some level.

But before we get to that point, there’s still an unholy conflict to be fought over the mainstream crypto market, and Robinhood and Coinbase are only just getting stuck into it.

HOOD vs COIN & The Future of Futures

HOOD and COIN will now do battle over who can best onboard an army of reluctant and still largely uninterested normies into crypto primitives.

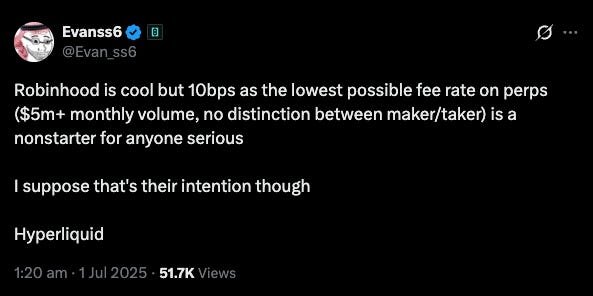

Not only that, but they will also wage war for who can best capture those who are already turbo-gambling on crypto on centralized exchanges, and try their best to pull market share from Hyperliquid.

While futures are currently regulated heavily by the CFTC and not entirely accessible to the retail market, it really looks as though retail-geared trading firms are positioning for relaxed legislation around perpetual futures in the US in the next few months.

While Robinhood is coming for mainstream retail, they seem relatively uninterested in capturing the bigger fish on perps, which will likely continue to enjoy the no-KYC benefits of Hyperliquid.

If Robinhood and Coinbase aren’t going to service the elite tier of traders, I’m not sure what platform will be capable of scalping and then retaining the big boys from Hyperliquid.

It could just be Hyperliquid’s book to run for the foreseeable future…

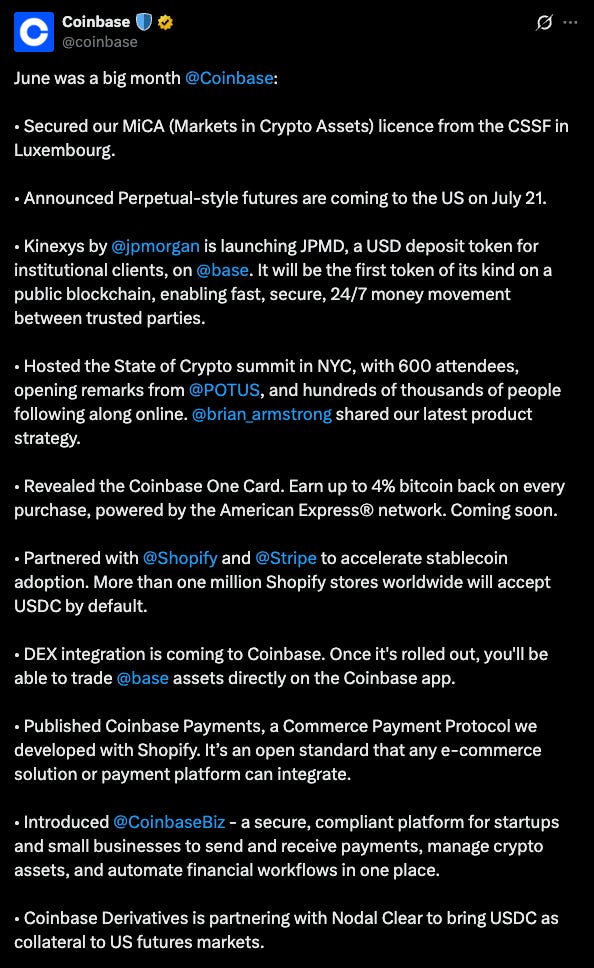

Coinbase also rolled out a massive list of product updates in June, some of which are more notable than others (perp futures, July 21).

Bankless founder David Hoffman appears to believe that Robinhood has a good shot at “leapfrogging” Coinbase in terms of product offerings, simply because the app’s internal UX and financial ecosystem of products is “tighter” than Coinbase’s. This is a pretty valid point when weighing up the two.

Coinbase has a very strong moat around on-chain activity with Base, but it would be a grave mistake for them to be remotely comfortable in their current position. Base has a decent uptake, but it’s ripe for disruption by a competitor who could create an on-chain ecosystem with more direction and user-focused applications.

Base seems confused about what it is and what it should do. From Jesse Pollak telling everyone to “coin” stuff so he could farm a Zora airdrop, to other cringe attempts to lure users into a stale and overly corporate “tokenization” narrative, Base is very much fumbling the bag compared to its higher-use competitors.

Market Overview

Trump’s inauguration and subsequent election were a tumultuous affair for our beloved tokens.

Markets really struggled to digest and effectively price in the international dick-measuring competition brought about by Trump’s tariffs.

Next on the list of price indigestion was continued geopolitical unrest in the Middle East, as well as escalating tensions between the US and Russia/China.

While these are still technically ongoing issues, prices in both crypto and traditional equities (SPX is currently sitting at ATH) reflect very bullish positioning from market participants.

Pav Hundal, the lead market analyst at Australian crypto exchange Swyftx, came on The NGMI Podcast to break down all of the macro factors behind the market’s newfound optimism.

Pav and I went over the obvious drivers like growing M2 Money Supply, but Pav also mentioned a lot of the behind-the-scenes stuff like new regulatory changes to the US Statutory Liquidity Ratios (SLRs) that could unlock over $200B in new liquidity fairly quickly.

Moving forward, I see Bitcoin (BTC) and Solana (SOL) as the two assets I’d want to own vile amounts of if I were allocating to the market right now.

A ‘hidden’ alt season

While many degens have been wishing for an “alt season,” on the basket of digital ponzi assets coins they top blasted in 2021 — an alternative alt season has been playing out in crypto equities.

Stablecoin issuer Circle IPO’d on June 5 for $31. It is now trading at $181, down a little from its all-time high of $263. A cool 8.5X on an initial day one bid (if you sold the top already).

Robinhood is currently sitting at an ATH stock price of $95 in after-hours trading, up over 310% in the last year.

Bitcoin treasury companies are another example of equities ripping by adopting a crypto strategy, irrespective of long-term utility. Companies like Metaplanet

Duck believes that while it may look toppy right now, we still have room for a lot more air in this balloon.

NGMI Capital Updates

The CIO has taken very few trades over the last few weeks.

One of the big wins was building a solid long position in SEI before the ETF announcement.

Aside from this, the CIO has been allocating NGMI Capital funds toward farming new protocols and building leverage exposure to the Solana ecosystem, primarily on Fartcoin.

Airdrop Farming

Because the CIO decided not to make generational wealth on Hyperliquid (he did not actively trade perps at the time), he has shifted his attention to farming some of the Hyperliquid ecosystem which is extremely well funded, and still has a bit of juice left to squeeze out of it for the on-chain agriculturalists among us.

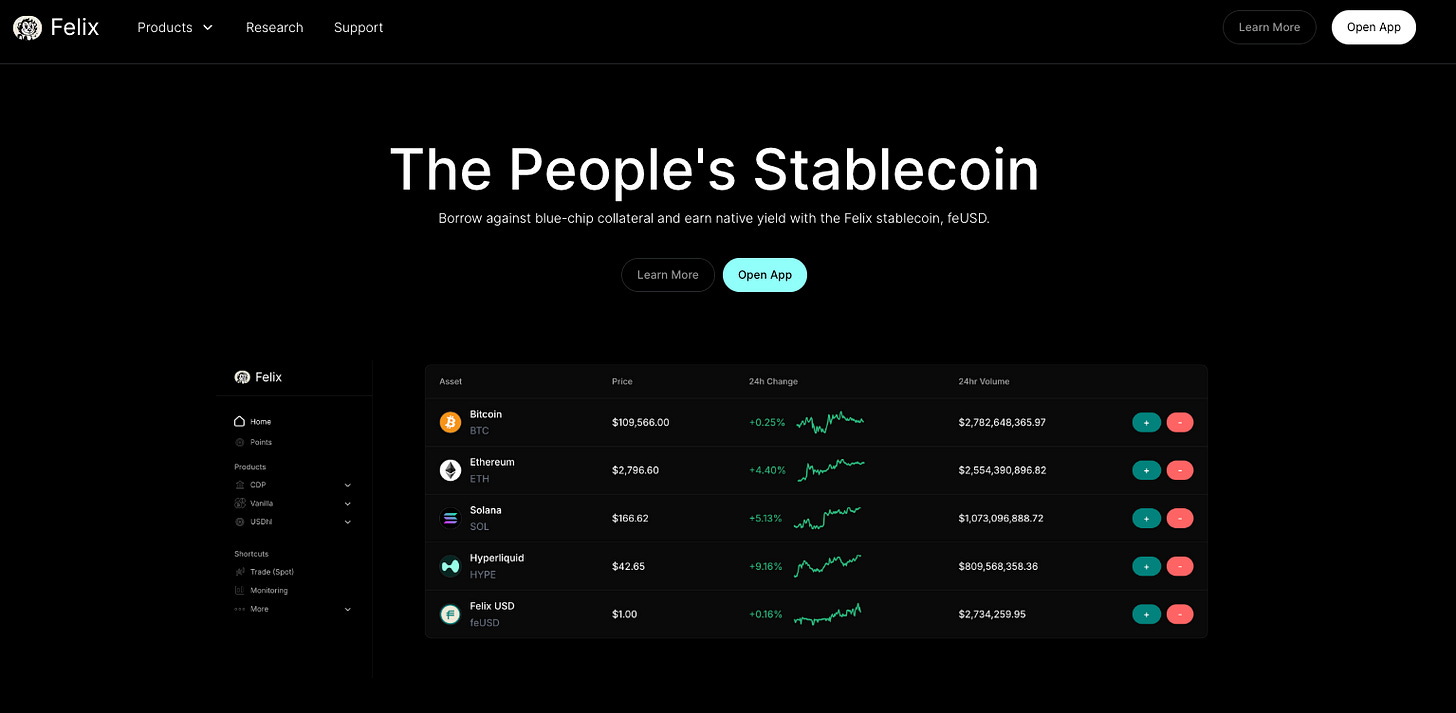

Felix Protocol

One of the standout protocols to farm is Felix Protocol a Money Market / DeFi protocol built on top of Hyperliquid.

Lending the protocols’ native stablecoin, feUSD and Hyperliquid’s native stable USDhl should be a good way to farm some extra points relative to borrow/lend on other assets.

Drift Protocol (Solana)

Drift protocol is a perp DEX on Solana. Even though they’ve already dropped their native DRIFT token, I think there’s a decent amount of upside in using the protocol to earn FUEL (their reward points).

You can choose to deposit dSOL (the protocol’s LST). Alternatively, you can just buy the DRIFT token and stake it as well; however, there is a 30-day lock-up period, which could be a negative if you’re after a quick exit.

You can sign up with this link and help us both earn more FUEL.

There are many others the CIO is actively farming, so he will have to write a separate overview in another piece because this newsletter is already dragging on a bit.

Portfolio

The CIO is currently holding personal long-term positions in the following coins.

(Listed by order of approximate weight)

USDC (USDC)

Fitcoin (FITCOIN)

Solana (SOL)

Bitcoin (BTC)

Pendle (PENDLE)

Prime (PRIME)

AicroStrategy (AISTR)

Dream Machine Token (DMT)Pyth Network (PYTH)A long list of complete Solana dogshit I do not feel comfortable sharing with anyone who could and would judge me for it.

NGMI is a major supporter of Infinex: a completely self-custodial decentralized exchange with UX so good you’ll forget that everything you’re doing is technically on-chain.

Infinex has now become my on-chain bank account.

As someone with 50+ wallets across EVM, Solana (and countless others), Infinex completely solves the wallet, DEX, and cross-chain bridging fatigue that comes with doing a lot of stuff on-chain.

You can gain exposure to the future growth of the platform and its eventual token airdrop by signing up and unlocking further exclusive perks by purchasing Infinex’s flagship asset: Patrons.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do.

All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.