The SEC Is Coming for Crypto

Here's what the regulator's newfound appetite for enforcement means for investors.

The US government is gunning for crypto.

Over the last few days there’s been a number of massive developments that have already begun radically re-shaping the future of the crypto industry.

As someone who covers the crypto industry for a living, I stay painfully up-to-date on all the latest regulation moves in the world of digital finance.

Here’s a quick breakdown of all the recent action against cryptocurrency in the US and what it means for the wider market in the long run.

I’ll explain everything in further detail later in the piece.

US crypto regulation summary

Feb 9: The SEC fined Kraken $30 million and ordered the exchange to shut down its crypto staking products.

Feb 13: The NYDFS ordered Paxos to stop issuing the stablecoin ‘BUSD’.

Feb 17: The SEC charged Terra Money founder Do Kwon with securities fraud.

The Kraken crackdown explained

On February 9, the US Securities and Exchange Commission (SEC) ordered the US-based crypto exchange Kraken to pay a $30 million fine and close down all of its ‘staking’ products.

The main crux of the ruling is that the SEC considers Kraken’s staking services to be something that looks a lot like a ‘security’.

If Kraken’s staking services are to be designated as such, it would impose a host of new regulatory requirements that many crypto players are simply unprepared for.

The major actors in the crypto industry felt the blow of this move immediately, with Coinbase shares plummeting 15% in a single day, the largest one-day drop since July last year.

On the same day, Coinbase CEO Brian Armstrong surfaced a troubling rumour, claiming the that the SEC were looking to come down hard on the practice of ‘staking’ more broadly.

While the SEC hasn’t come out and declared anything outright, rumours that they may eventually move to ban the practice of crypto staking in its entirety has ruffled feathers in the industry.

Such a move would majorly disrupt all the day-to-day operations for blockchains that run on a Proof of Stake consensus mechanism, which include the likes of Ethereum (ETH), Cardano (ADA) and Solana (SOL).

The Paxos crackdown explained

The next biggest move against crypto came on Sunday the 12th of February, when the SEC announced that it would be launching a lawsuit against a crypto firm called Paxos Trust Co.

Paxos is the company responsible for the creation of Binance’s ‘BUSD’ stablecoin.

The next day, the New York Department of Financial Services (NYDFS) also issued an order that prevents Paxos from ‘minting’ any new BUSD stablecoins.

The most troubling part of the legal action against Paxos — aside from the fact that it shut down the stablecoin of the world’s largest crypto exchange — is that it’s trying to regulate the BUSD token as a ‘security’.

If the SEC are successful in regulating ‘BUSD’ stablecoin as a security, it could pose significant barriers to entry for all other US-dollar stablecoins and see millions (potentially billions) of dollars worth of liquidity disappear from the market altogether.

It’s worth noting that the crackdown on Paxos is also a very thinly-veiled attack on Binance, currently the world’s largest crypto exchange. By cutting off its BUSD stablecoin, the exchange has been forced to find an alternative stablecoin and the move symbolises the fact that regulators are continually finding new and unexpected ways to crack down on crypto exchanges.

Essentially, the fact that the SEC wants to see BUSD regulated the same way as financial instruments like stocks and bonds is cause for concern in the crypto industry.

Instead of going after individual cryptocurrencies like Bitcoin (BTC) and Ethereum, the SEC is looking to cut crypto off at its knees by cutting of the supply of liquidity to the broader market.

If the SEC can legally declare BUSD as a ‘security’, then it opens the door for litigation against other stablecoin providers like Circle and its US-Dollar stablecoin USDC. It goes without saying, but this would have wide-reaching negative impacts on the price of cryptocurrencies.

Quick stablecoin explainer:

Stablecoins act as the primary source of ‘liquidity’ in crypto markets.

Instead of crypto investors being forced to exclusively hold volatile assets like Bitcoin and Ethereum, they can cash out into tokens that have their value tied to the US Dollar, making it a “stable” way of cashing out of crypto without going through all of the tax headaches that come with fully cashing out into fiat currency.

Do Kwon charges explained

The SEC has filed a lawsuit against Do Kwon, the founder of the Singapore-based crypto firm Terraform Labs which was responsible for the creation of the Terra USD (UST) token and its sister token Terra (LUNA).

The regulator accused Kwon of misrepresenting the risks that accompanied investing in the Terra Money ecosystem, as well as misleading investors about how LUNA was actually used to maintain the stability of UST.

The SEC said in its court filing that Do Kwon’s scheme led to the loss of “at least $40 billion” in total market value. The total value of the Luna token in April last year was counted among the 10 largest cryptocurrencies in the world.

In September last year, prosecutors in South Korea obtained an arrest warrant for Kwon and issued a ‘red notice’ for him with the global law-enforcement agency Interpol. As of right now, Kwon’s personal location right now remains unknown to the public.

While this move is essential for bringing bad actors like Do Kwon to justice, the ensuing legal case could bear interesting precedents for the regulation of cryptocurrencies, particularly as it relates to algorithmic stablecoins.

This could have unintended consequences for similar algorithmic stablecoins like DAI, FXS and CurveDAO.

Other problems in the crypto market

Institutional interest in Bitcoin has dried up

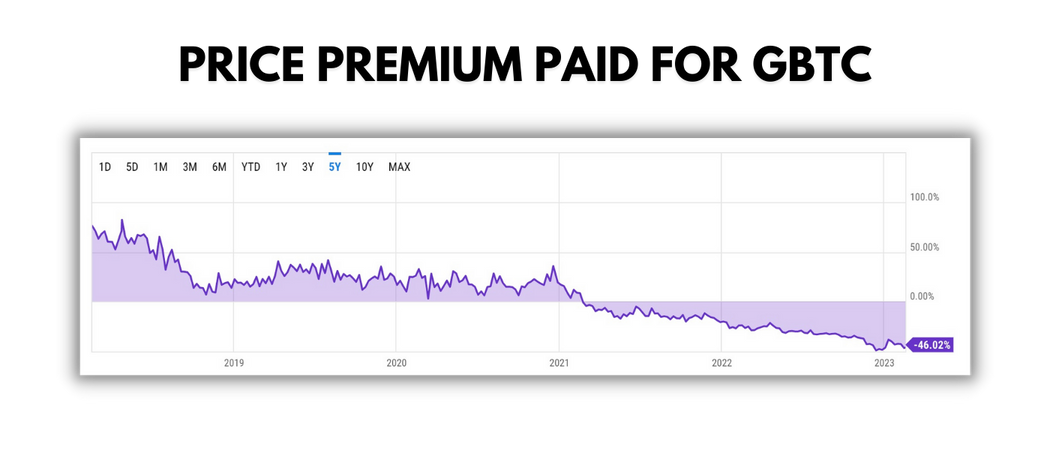

Grayscale Bitcoin Trust (GBTC) is the largest crypto investment vehicle available on public markets.

The graph attached below shows the price premium that are investors are willing to pay for access to the GBTC product. Unfortunately, companies simply aren’t interested in holding Bitcoin on their books.

Since late-February 2021 GBTC has been trading a discount, which means that institutions have been paying less and less to access Bitcoin. At the time of writing, the price that investors are willing to pay for access to GBTC is a staggering 46% below its real Net Asset Value (NAV).

In simpler terms; ‘GBTC’ allows private investors to gain exposure to the crypto market without owning any real cryptocurrency. GBTC is owned by Grayscale Investments, and they currently own a slowly decreasing number of approximately 630,000 Bitcoin worth nearly $15.6 billion.

Because a direct bitcoin ETF (Exchange Traded Fund) isn’t permitted by the SEC; stating that liquidity issues and a heightened volatility risk to investors was not allowed under standard regulation — Grayscale quickly emerged as the next best thing.

Overall, the crypto market couldn’t care less

Regardless, the ever-speculative crypto investors don’t seem to be too worried, with the price of Bitcoin jumping nearly 15% over the course of the last week.

Still, sentiment in crypto is notorious for turning on a dime, and I’m personally wary that if the SEC does deem that ‘BUSD’ a security, the ruling of the case could cause a sudden and rapid crash.

For further reading on the SEC’s broader crackdown on crypto, you can read the following Substack post, where venture capitalists Nic Carter and Mike Solana accused the Biden administration of trying to “quietly” ban Bitcoin, Ethereum and many other cryptocurrencies.

Carter’s post, dubbed “Operation Choke Point 2.0” — which is a reference to a 2013 government program that looked to remove undesirable industries from banking services — slammed the US for orchestrating a “sophisticated, widespread crackdown” against the crypto industry.

While the market may be strangely euphoric right now, the SEC’s newfound appetite for all things ‘regulation by enforcement’ should be cause for concern.

If you enjoyed reading this, you can also choose to support my overall work on Patreon.

You can also find me on Twitter & Substack.

I’m also currently working on a Youtube channel, but unfortunately there’s only 24 hours in a day and my full-time job takes up the bulk of them.