The Death of Alt Season & The Continuation of Sector-Specific Speculation — NGMI Newsletter #12

the end of "alt season," why a shitload of alts will still melt faces, bitcoin dominance & all time july, market overview, treasury company ponzinomics, NGMI Capital updates & more.

Happy all-time July everyone.

Bitcoin has just broken through to a new ATH and at the time of publication, is trading at a very respectable 119,000 United States Dollars per individual BTC.

With Bitcoin marching through resistance and smashing a new top out of the park, the calls for “altcoin season” are growing louder — but I’m reluctant to think we’ll see anything like we did in 2017 or 2021.

Before you read any further, I cannot stress how much this piece should not be miscontrued as a fundamentally bearish position on all altcoins.

I think there will be a ridiculous number of opportunities in alts, and many squillions of dollars can be made by being positioned correctly further along the risk curve.

But this captive idea that every last token, including Cardano (ADA), Polkadot (DOT), Hedera (HBAR) and every other dinosaur asset people have miserably bagheld for the last 5 years, will suddenly pump and make them all overnight millionaires seems beyond idealistic and would break every single capital allocation pattern that’s formed over the two and a half years.

There are a few reasons I think a classical “alt season” — a multi-month period where everything rips face to multi-billion-dollar valuations — and here they are.

1. HyperMegaDilution

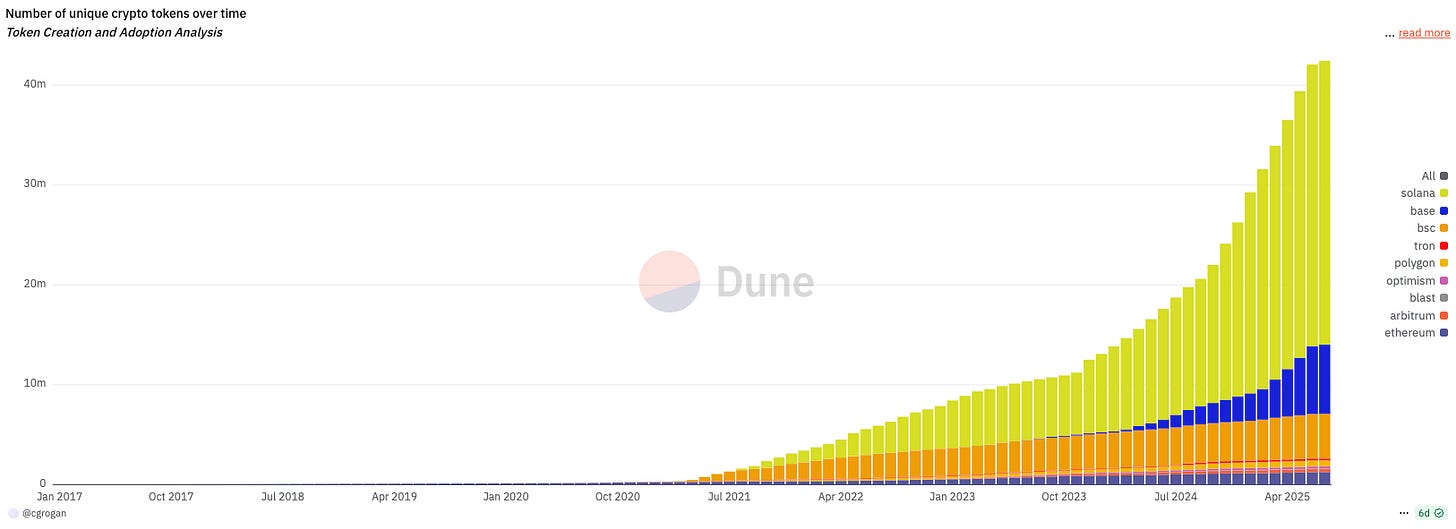

For starters, there are simply too many coins to hold the belief that every single piece of dogshit ever minted on a blockchain is going to yoink itself to new all-time-highs because ETH/BTC bottoms or whatever indicator you choose to mark the beginning of an alt szn.

As of today, there are 42 million individual tokens in the raw and beautiful free market of cryptographically-secured internet coins.

While the vast majority of these are no doubt “dead” sub 5k market cap shitters relegated to their digital graveyards of pump.fun, the market for attention and the number of potential places to deploy capital has been blown wide open.

2025 vs. 2021

I’m making a slightly glorified and myopic appeal to history to make a point here (and focusing solely on memes), but in 2021, there were three major memecoins worth paying attention to: Dogecoin (DOGE), Shiba Inu (SHIB), and Floki (FLOKI).

This is a far more lenient environment for the average degenerate speculator to full-port a coin, white-knuckle some volatility, ignore financially sound advice from their loved ones, and hopefully make a shitload of money on an inherently worthless token.

Now, attention is split between a theoretical maximum of 42 million (and constantly growing) ways.

Some basic arithmetic:

infinite coins x finite attention = lower capital concentration

While there are technically tens of millions of memecoins available to us now, in practice, it looks a lot more like 100(ish) major memes all vying for the finite and increasingly fragmented attention of terminally online speculators.

It doesn’t take a genius to realise that “100” is a much larger number than “3” and would require significantly larger sums of capital to see a similar style of value appreciation of DOGE, SHIB, and FLOKI in the glory days of yesteryear.

In theory, if we wanted to replicate the same style of vertical run-ups we saw in 2021 with the number of memecoins we have today, the TOTAL3 market cap would need to be at least 33 times larger than it is now, and all of that capital would have to be concentrated solely in memes.

This isn’t to say that select coins can’t or won’t run. This is clearly not the case. We have had a very respectable number of tokens (primarily memes) run from nothing to $1 billion+ valuations in the last 18 months.

It just means that the relative upside of larger alts and memes is fundamentally muted because so many participants are apeing junk way too far out on the right tail of the risk curve, praying they hit the next 1000X.

2. New Capital Is Hitting Bitcoin & Staying There

Retail Vs Insto

You’ve heard this one before, but this cycle has been entirely institution-led.

BlackRock and Larry Fink rubber-stamped Bitcoin with the approval of spot BTC ETFs in 2023.

This has seen insto capital take the lead on BTC price action. We’re already witnessing how Bitcoin grinds upwards and witnesses fewer and fewer of the feverish peaks and troughs that we bore witness to in prior market cycles.

It also means that a lot of the new retail net buyers of Bitcoin are gaining their exposure solely through managed funds and other TradFi rails, which massively reduces the surface area for speculating on alts.

Unlike the retail and degenerate mercenary fund-driven altcoin eras of 2017 and 2021, people aren’t buying the bulk of their Bitcoin through centralized exchanges, where the UX of doing so lends itself inherently to cycling profits out of Bitcoin and then slapping that capital into a long list of delicious looking altcoins readily on display inside one’s Binance account.

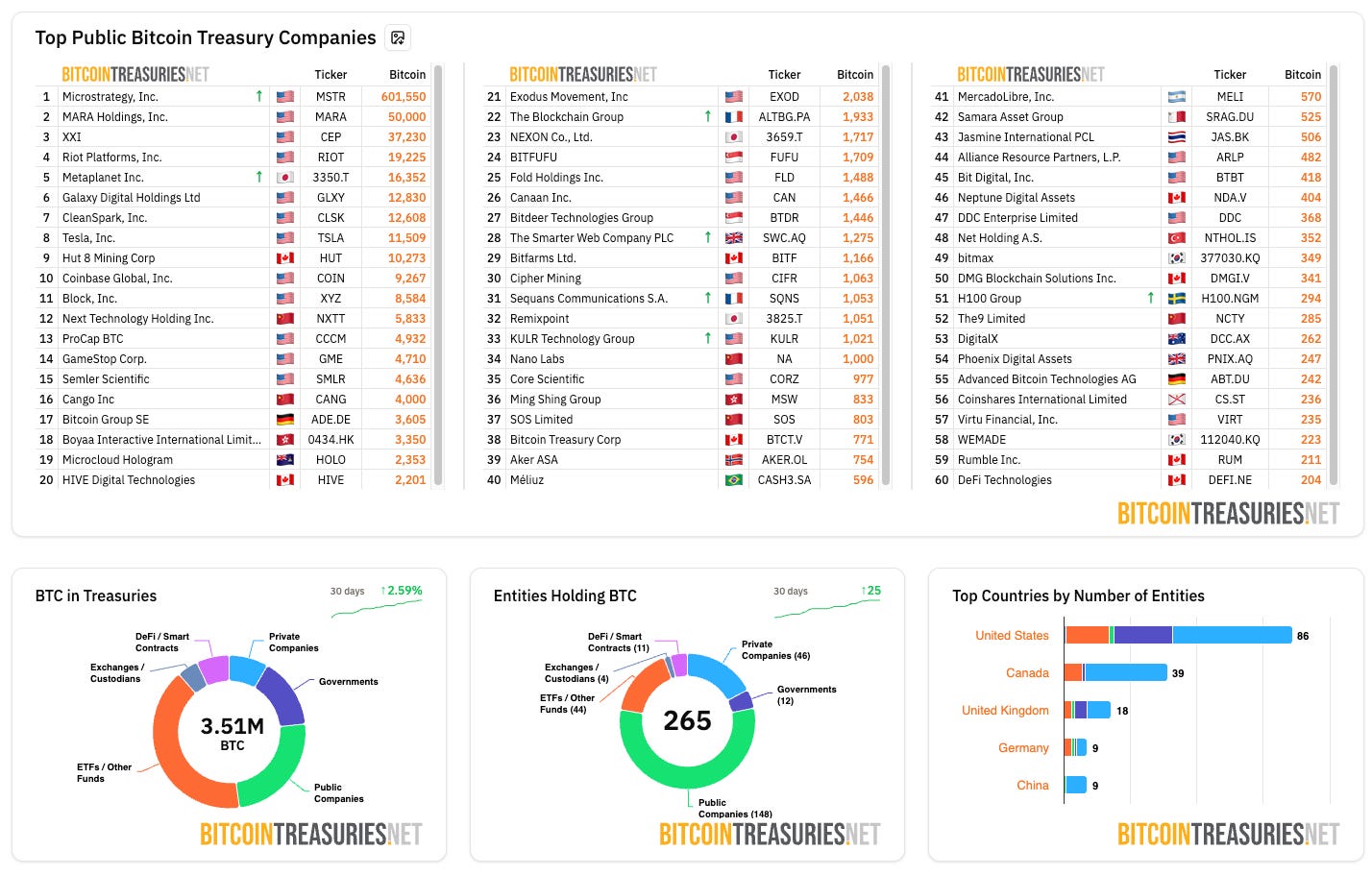

Bitcoin Treasury Companies

Another potential nail in the coffin of a generational alt season is the rising popularity of Bitcoin (and other crypto) Treasury Companies — which actually present a lower-aggregate risk option for mercenary VC and prop shop capital looking to turbo-gamble on crypto when compared to altcoins.

These things are currently vacuuming up what can be very simply imagined as “retail-institutional” capital — the degenerate fund money that once was piled into alts by mercenary VCs and prop shop/smaller fund cowboys looking to extract as much as humanly possible from retail by turbo-bidding the alt-Ponzi narrative.

Treasury companies — which seem like nothing more than an elaborate Ponzi mechanism only used by zombie companies to re-gain relevance and run up some quick numbers — are far more insulated against ridiculous downside than traditional alts are.

This is because they’re promoting a model of accretive dilution by copying the MicroStrategy model of issuing mostly unencumbered debt to purchase more Bitcoin, meaning that the risk of these things being margin-called on a single BTC death wick is lower than many might think.

Combine this with the fact that BlackRock and all of the other institutions giga-TWAPing Bitcoin are muting its downside volatility, and you have a recipe for a highly concentrated BTC run-up while the capital that moves to the further end of the risk curve on alts continues to grow at a much smaller relative rate to BTC.

All of this leads me to believe that we’ll continue to see a long-term continuation of BTC dominance rising over time.

Clearly, some of this liquidity is going to trickle its way back into the market for alts, but the gains from BTC and appreciation will be more siloed than ever before.

Instead of experiencing a “rising tide that lifts all boats,” rally across an eternally expanding pool of altcoins — we’ll continue to see this constantly rotating hot-ball of money, where narratives in specific niches will run extremely hard but only at the expense of liquidity elsewhere.

3. [Caveat] “Dino” alts could still catch a decent bid

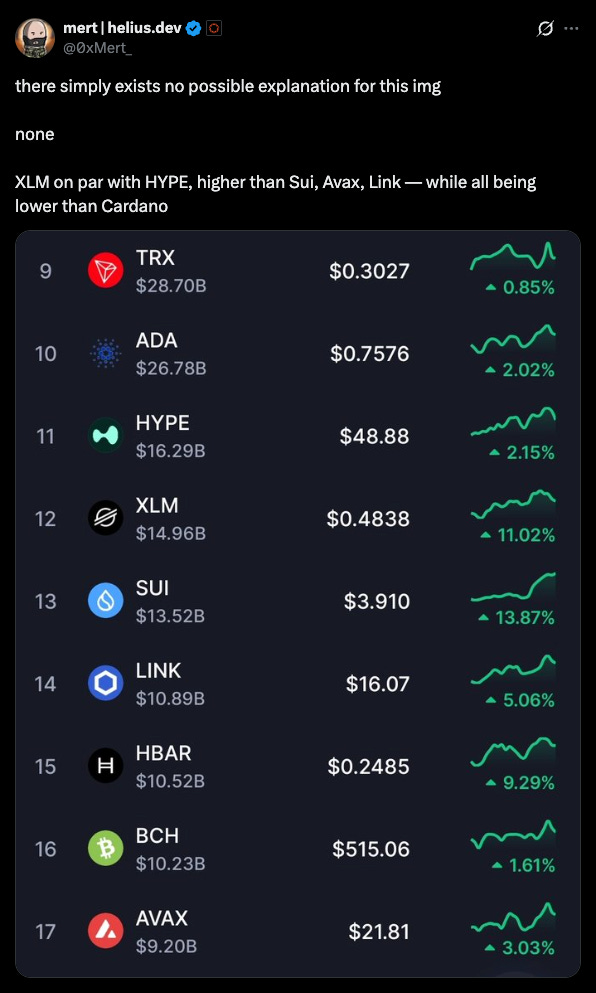

While the following list of tickers — specifically XLM, ADA, BCH & HBAR — may seem confusing to crypto natives, it’s no mystery why a lot of these coins tend to turbo pump despite many of their networks being hardly used by any in the crypto ecosystem.

However, now that I work outside of pure crypto and engage more heavily with the education space, I’ve learned that a lot of more prevalent “mainstream” crypto education functions by instructing everyday people to simply turbo-long & spot ape this class of dino coins because there’s existing ‘“chart structure / TA fundamentals” — which explains a chunk of why there’s such an incessant bid during times of a major BTC uptrend.

When you combine this with the hefty insto leverage from the Korean/SE Asian exchange cabal on pairs like XRP, ADA & HBAR — you have the perfect recipe for truly inexplicable god candles that make non-crypto normies very wealthy while CT eternally PVPs on dogshit in the trenches.

Market Overview

Bitcoin

Bitcoin tapped a new all-time high of $122,238 on July 14.

No further analysis needed. Assume BTC continues the uptrend for a while.

Going to be a very good H2 2025.

Ethereum

The setup for Ethereum looks wonderful here.

ETH has just broken through the last range trough from February, and institutional bids are starting to roll through on ETH ETFs.

Comparatively, its largest L1 competitor, Solana, has become increasingly diluted with

I know I’ve spent the last 18 months shitting ruthlessly on both of these ecosystems, but I unironically think that Farcaster and Base ecosystems are primed for breakouts given the upcoming Farcaster airdrop and the general hatred towards Base by practically everyone.

Solana

Solana (SOL) stands on a knife’s edge here.

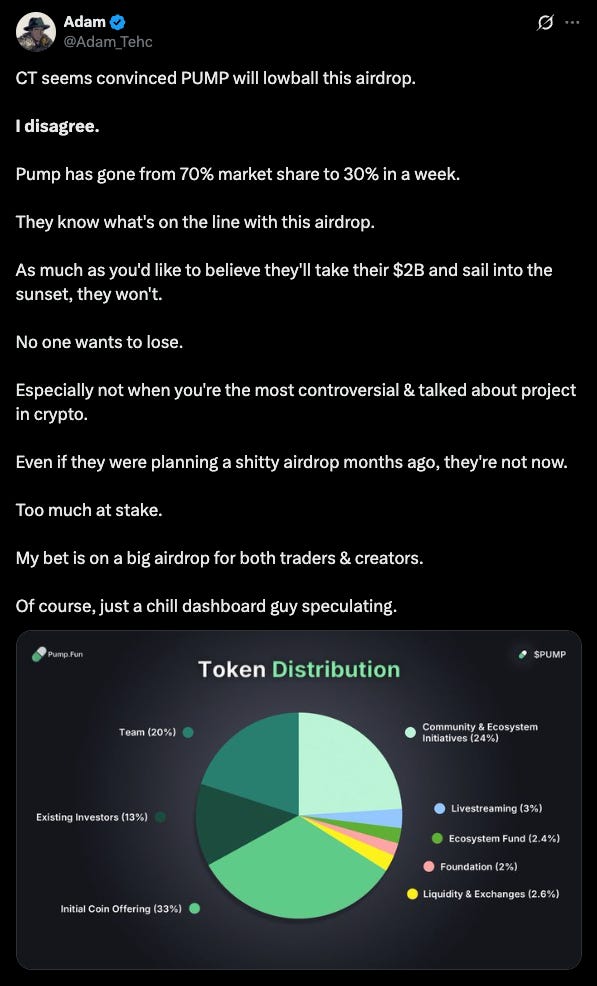

With the pumpfun airdrop having landed, I’m torn between its potential to inject liquidity back into the Solana ecosystem by way of a price-appreciating airdrop or — if the PUMP token performs very well (in the absence of a well-distributed airdrop for a high number users) — it becomes the liquidity black hole that puts the local top on Solana for a good while.

I’m (probably foolishly) leaning more toward the bullish side for Pump and the SOL ecosystem, but a lot of it will depend on the competition between the Bonk ecosystem and Pump.

The ideal bull scenario would look like Pumpdotfun aligning incentives against pure extraction and encouraging long-term use of its product by pushing higher ROI on meme gambling (by way of streaming and other PUMP-related incentives) WHILE the Bonk ecosystem continues to funnel market activity back into the network.

NGMI Capital Updates

The CIO of NGMI Capital has been fairly out of sync with markets and has not been on a “heater” when it comes to trading smaller positions.

International Meme Fund

After fading a nice 50X on the International Meme Fund (IMF) — a DeFi protocol where degens can lend and borrow against their memecoins — the CIO decided to buy in much, much higher, but now has an almost respectable amount of exposure to the protocol.

A few months ago, the CIO interviewed Gami, the Cartel Boss of the IMF.

If you’re looking to get some insight into why IMF is over 80X off the bottom, this is for you.

Graphite Protocol

With the sudden rise of the Bonk ecosystem as a competitor to Pumpdotfun (it’s launched bonk.fun has been doing higher revenue than Pump for over a week now) the CIO decided it was a good time to gain exposure in the most effective way possible.

Enter: Graphite Protocol.

7.5% of Bonk.fun revenue goes to Graphite Protocol

While the memecoin Bonk (BONK) receives 50% of fees, it’s currently at $2.3B mcap while GP is currently sitting at $64M mcap.

TLDR: Bonk fun fees/revenue is roughly 5-7X more effective at driving price action on Graphite Protocol than it is on BONK at these levels.

Assuming that Bonk continues to compete with Pump for market share of memecoin deployment and on-chain turbo-gambling, the CIO has sized into GP to capture ongoing upside.

The CIO is also building very small spot positions in super low market cap tokens on ETH, Base, and Farcaster, as the ecosystems feel like they have the most upside relative to Solana. They are too small and speculative to share in a newsletter right now but they will be updated in the next one.

Outside of this, the CIO made a decent-sized bid on Flipr Bot (FLIPR) on Solana.

Flipr is a bot that allows users to make Polymarket bets entirely on Twitter, so they no longer have to leave the platform to speculate on Polymarket odds.

The app is still a bit glitchy, and the position is classified as fairly high-risk. If they can get their bot to work seamlessly across social media, this protocol has high narrative and earning potential if they can successfully build out revenue/buyback models into the system.

Portfolio

The CIO is currently holding personal long-term positions in the following coins.

(Listed by order of approximate weight)

USDC (USDC)

Graphite Protocol (GP)

Fitcoin (FITCOIN)

Flipr Bot (FLIPR)

Solana (SOL)

Bitcoin (BTC)

Pendle (PENDLE)

Prime (PRIME)

AicroStrategy (AISTR)

International Meme Fund (IMF)

Dream Machine Token (DMT)Pyth Network (PYTH)A lengthy list of complete Solana dogshit the CIO does not feel comfortable sharing with anyone who could and would judge him for it.

NGMI is a major supporter of Infinex: a completely self-custodial decentralized exchange with UX so good you’ll forget that everything you’re doing is technically on-chain.

Infinex has now become my on-chain bank account.

As someone with 50+ wallets across EVM, Solana (and countless others), Infinex completely solves the wallet, DEX, and cross-chain bridging fatigue that comes with doing a lot of stuff on-chain.

You can gain exposure to the future growth of the platform and its eventual token airdrop by signing up and unlocking further exclusive perks by purchasing Infinex’s flagship asset: Patrons.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do.

All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.