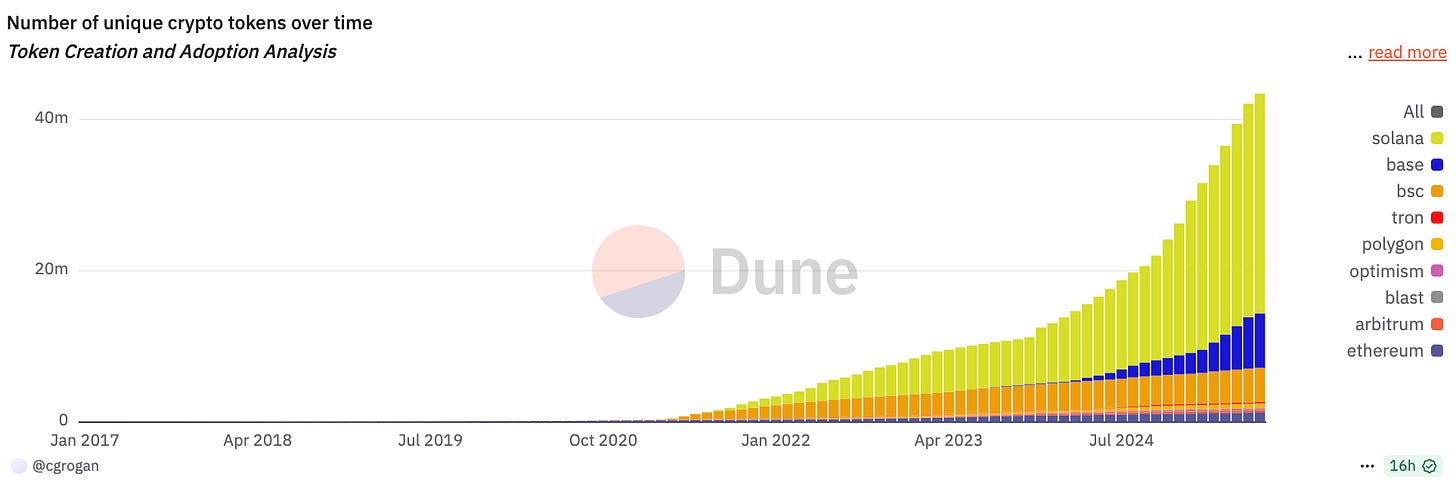

Right now, more than 45 million individual tokens are circulating in the raw and beautiful free market of crypto assets.

This staggering number of total cryptocurrencies can be traced almost solely back to the meteoric success of the low-cost, single-click memecoin deployer Pump.fun on the Solana network and the tidal wave of subsequent imitation launchpads that followed in its wake.

29 million (66%) of the total 43.4 million altcoins can be found on Solana, thanks entirely to the supremacy of Pump.fun, which found its perfect product market fit with the speed, throughput, and normie-friendly UX of the Solana network.

In comparison, 7.1 million tokens have been launched on the Coinbase-incubated Ethereum L2 Base, 4.5 million tokens belong to Binance Smart Chain, and 1.2 million have been launched on the Ethereum mainnet.

To put these numbers in context, in January 2021, there were just 277,000 total tokens across the same group of blockchains, with the vast majority (240,000) of these launched as ERC-20s on Ethereum.

Since the beginning of 2021, we have witnessed a 15,000% increase in the total number of circulating tokens.

This presents us with an interesting dilemma:

For seasoned memecoin degenerates and the less-sophisticated class of investors we call retail, the newfound ability for anyone with a Phantom wallet and $5 to their name to launch a near-infinite number of new coins at practically zero cost has made it incredibly difficult to allocate capital in a meaningful way over a long time period on more speculative tokens.

While we can lament the fact that there are “too many coins” and imagine how much easier it would be to invest in an ecosystem with millions fewer tokens, this train only runs in one direction.

So, let’s break down how pump.fun has altered market dynamics and address some of the major claims levied against it.

Breaking down the impact of Pump.fun

There are two primary arguments levied against pump.fun and its impact on the wider crypto market.

1. Pump.fun is fundamentally ‘extractive’

Scroll down the timeline of the insane asylum affectionally known as Crypto Twitter, and it won’t be long before you find someone pillaging pump.fun for being “stunningly extractive” or saying that it “enables, exploits, and perpetuates the most nihilistic aspects of crypto.”

Sure, the meteoric success of pump.fun and its tens of millions of tokens is not really among the desired outcomes for market participants hoping to strike it big on memecoins, but to describe the protocol itself as being “fundamentally extractive” to crypto — or even to Solana — misses the mark entirely.

Put simply: the pump.fun team launched a protocol that a lot of people wanted to, and did, use.

Pinning them with the blame of “enabling the most nihilistic aspects of crypto” or saying they are fundamentally “exploiting” users is an underdeveloped argument for an industry that prides itself on the principles of freedom and decentralization.

Pump.fun holds a mirror to the desires and behaviors of everyday participants in the crypto market.

If the most popular behaviour is turbo-gambling on worthless shitters, then that’s an uncomfortable and unfortunate reality to face, but it’s hardly reasonable to lay the blame solely at the feet of a protocol that experienced the best PMF with cryptocurrency degenerates since OHM forks.

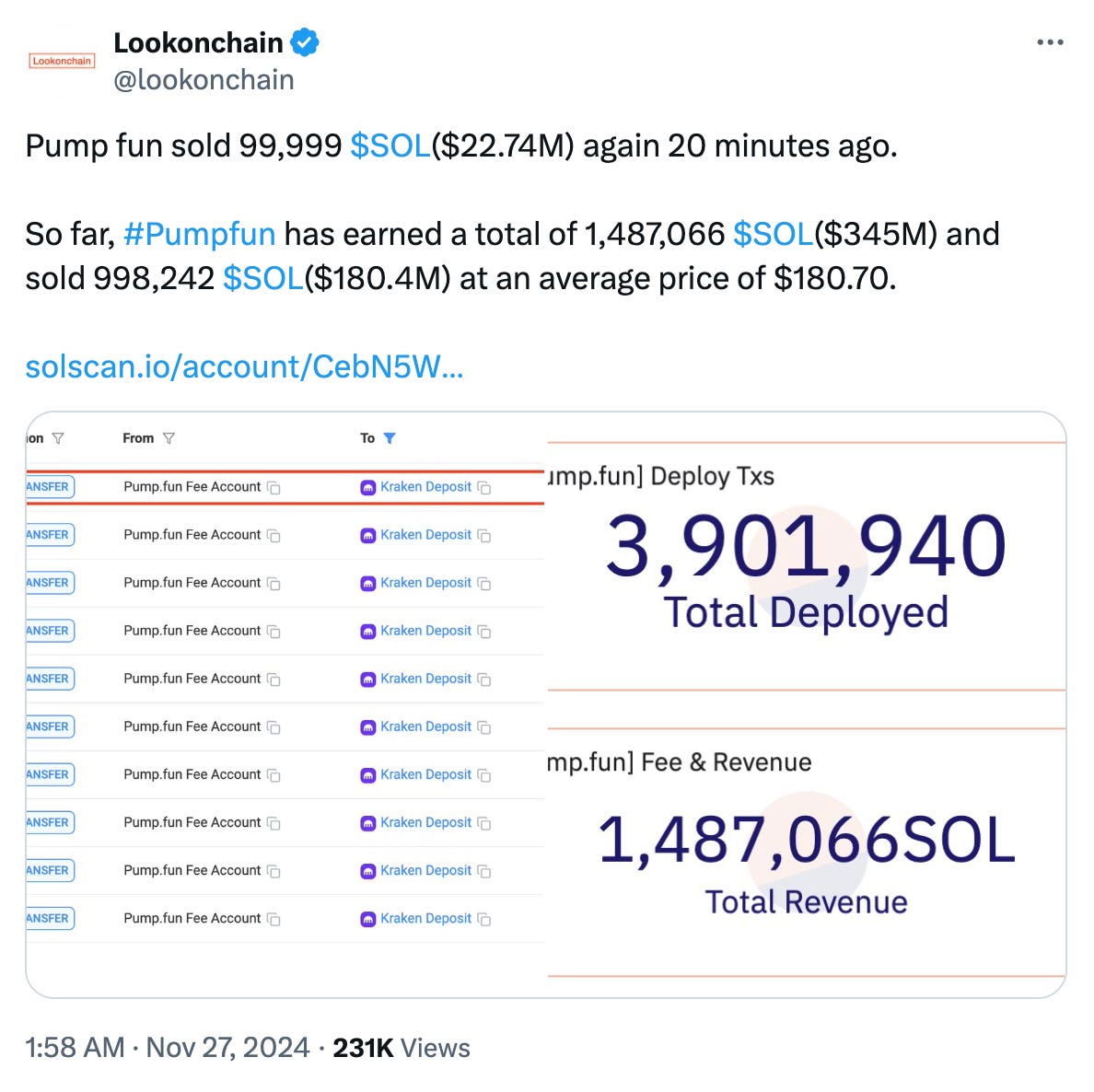

Many social media posts concerning the use of SOL claim that Pump.fun devs are just raking in revenue from useless degens, cashing out as much as humanly possible, and fucking off into the sunset, all while flipping the middle finger to Solana and its users on the way out.

Even though Lookonchain has repeatedly said that “Pump.fun sold $180M in SOL” it’s worth noting that Lookonchain has repeatedly assumed that the Pump team is selling the SOL because it’s being deposited on Kraken.

Pump.fun founder Alon has addressed these claims and stated that nothing near that amount of SOL has actually been sold by the team.

Secondly, Pump.fun is a business.

It earns (a shitload of) revenue, and it has no obligation to keep funneling its profits back into the crypto ecosystem.

Many other trading platforms on Solana, including the prominent market leaders Axiom and Photon, have also cleared well over 9 figures in fees from degenerate gamblers, but you very rarely see hordes of angery people accosting them on the timeline for this…

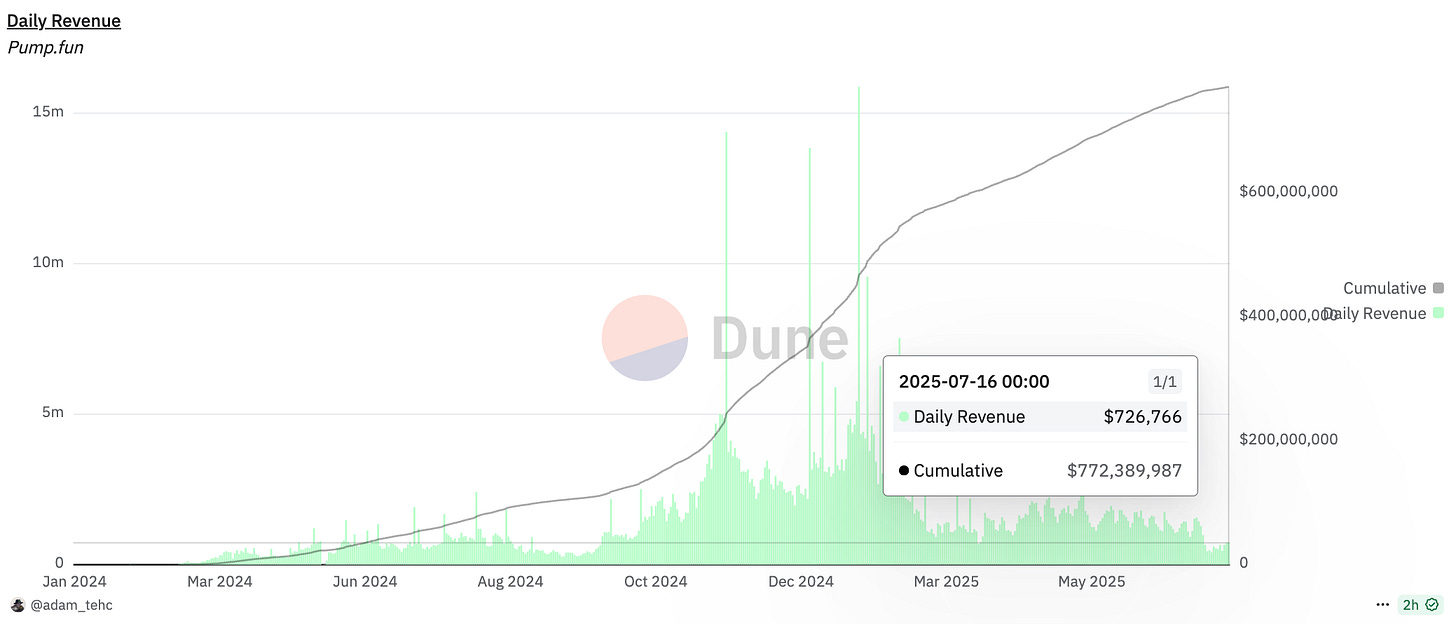

The over-simplified extraction argument is also a prima facie criticism, considering that the protocol has generated a very healthy $772 million in revenue since its launch on January 13.

Most notably, this simplistic analysis of adding up total revenue and assuming the team has net-turbo-extracted Solana out of the ecosystem forever leaves out some very crucial points — namely, the amount of SOL that’s locked away forever (burned) in the liquidity pool of each individual token that “graduates” from the pump.fun dashboard and into a liquidity pool on Raydium (and now PumpSwap).

Pump.fun acts as a burn mechanism for SOL

Pump.fun utilizes a bonding curve model to provide guaranteed liquidity for newly launched tokens once they make it to Raydium (now PumpSwap — the protocol’s in-house AMM).

Once a token reaches a $74k market cap, the bonding curve is completed, and the token is launched on an AMM with a guaranteed $17,000 in liquidity.

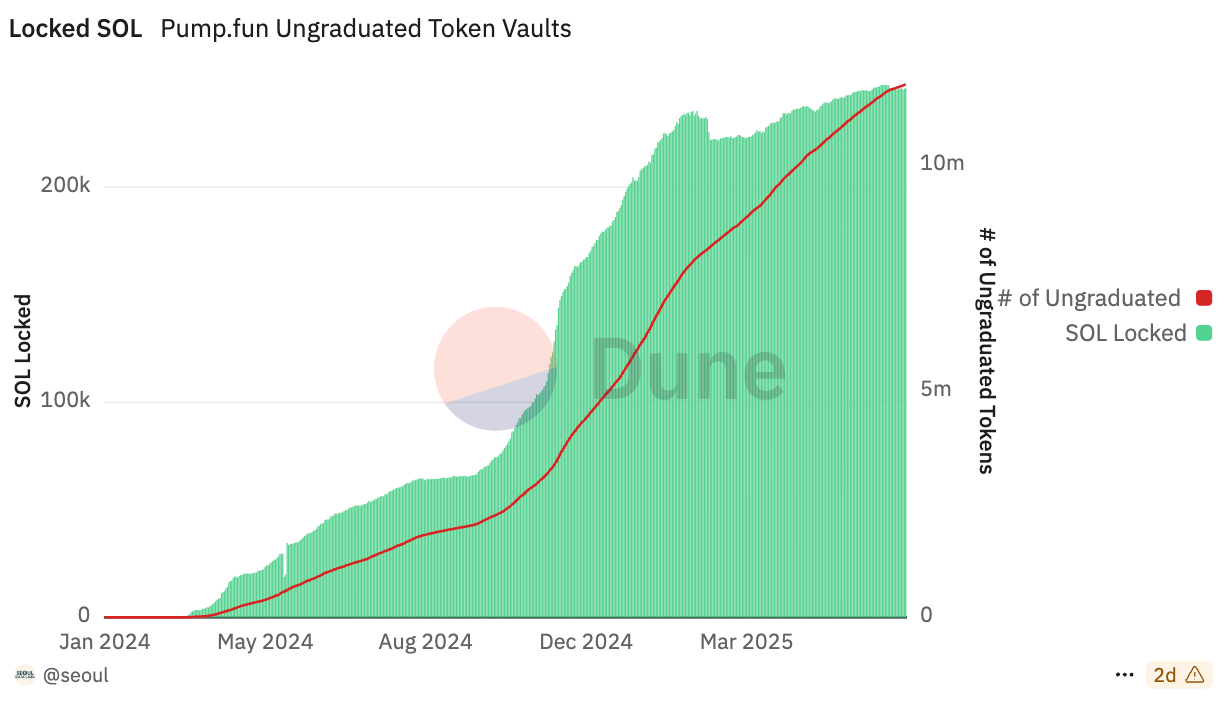

One of the more-overlooked, positive effects of Pump.fun and other launchpads is the accretive burning effect of locking SOL up in bonding curves forever.

Let's take a look at how much SOL is locked in the Raydium liquidity pool of a “dead” token with a $5.6k market capitalization and a whopping $7 in daily volume.

We can see that just over $3,200 in SOL at current is locked in that token forever.

These numbers can vary slightly depending on the previous price action of the token (how much SOL was bid into the bonding curve), but the aggregate sum locked in bonding curves is typically between $3000-$5000 on dead tokens.

This means that whenever a pump.fun token successfully fills its bonding curve and graduates, we can estimate that a minimum of approximately $3000 in Solana (~17 SOL at current prices) is burned forever.

As of July 18, 148,392 tokens have graduated from pump.fun.

In the bonding curves of graduated tokens alone, a minimum of $445 million in SOL has been removed from the circulating supply forever.

That’s not even considering the other 12 million tokens that never reached graduation, which still lock up incrementally smaller amounts of SOL in their bonding curves.

According to data from Seoul Labs, 245,930 SOL ($44 million at current prices) is currently locked in the bonding curves of ungraduated tokens.

In total, approximately $489 million in SOL (0.47% of the total circulating supply of Solana) has effectively been burned by Pump.fun.

Pump.fun as a single entity = net-positive for Solana

If we zoom in on the specifics of publicly available data for pump.fun as a single entity (and exclude the hard-to-quantify stuff like extraction from the nefarious users of the protocol), the protocol has actually been for Solana, looking at the protocol’s individual net-sales of SOL vs. the total locked SOL in liquidity pools.

Pump.fun has only publicly sold $42 million worth of SOL, while the total sum locked in bonding curves exceeds ~$480 million.

Obviously, this data excludes the massive extraction events that come from serial deployers spinning up tokens and dumping on the heads of retail plebs trying to win big in the trenches, but that’s a different point entirely.

Donald Trump’s memecoin TRUMP and the frenzy of other hyper-extractive memecoins: LIBRA (Argentina’s scam coin), HAWK (Hailey Welch’s scam coin), CAR (The Central African Republic’s scam coin) etc. were all launched by private teams on Meteora and likely extracted far more from the ecosystem in less than 30 days than all of of tokens launched on pump.fun ever did.

Now, I fully expect many crypto puritans or idealists to bemoan that this purely economic argument of: “oh good, at least there’s been more SOL burned from degenerate gambling than what was taken out by the protocol.”

Many would (and will) accuse me of being a sellout and claim that this falls short of crypto’s noble cypherpunk ideals of creating stateless, public money on the internet and ushering in a new era of financial freedom for its users.

This is a self-defeating and low-agency position to have.

Just because you think something should be the case has absolutely no bearing on what occurs in reality.

If you are truly invested in seeing through crypto’s noble ideals, do something about it and stop scolding a product that took off because it doesn’t fit your holier-than-thou template of “ideal” crypto use cases.

2. Pump.fun has killed memecoins

It’s no secret that the introduction of pump.fun on January 13 last year has been catastrophic for memecoin traders looking to buy a “funny” or “culty” coin and hold it forever — but to claim that it has “killed” memecoins is a bit of a stretch.

Pump.fun didn’t kill memecoins. However, it has made the game infinitely harder for the average retail participant.

Infinite coins. Finite attention

You’ll have to forgive me while I make a glorified appeal to history and gloss over the more granular details of the number of memecoins in past years, but in 2021, there were pretty much just three major memecoins worth paying attention to: Dogecoin, Shiba Inu, and Floki.

This is a far more lenient environment for the average degenerate speculator to full-port a coin, white-knuckle some volatility, ignore financially sound advice from their loved ones, and hopefully make a shitload of money on an inherently worthless token.

Now, attention is split between a theoretical maximum of 37.7 million (and growing) ways.

This comes down to some pretty basic arithmetic:

near-infinite coins x finite attention = lower capital concentration

While there are technically tens of millions of memecoins available to us now, in practice, it looks a lot more like ~50 (potentially) major memes all vying for the finite and increasingly fragmented attention of terminally online gamblers.

It doesn’t take a genius to realise that “50” is a much larger number than “3” and would require significantly larger sums of capital to see a similar style of value appreciation of DOGE, SHIB, and FLOKI in the glory days of yesteryear.

In theory, if we wanted to replicate the same style of vertical run-ups we saw in 2021 with the number of memecoins we have today, the TOTAL3 market cap would need to be at least 33 times larger than it is now, and the bulk of that capital would have to be concentrated solely in memes.

All the same, degens and community members will believe their chosen coin to be different, but this kind of bullish hopium just doesn’t reconcile with the sheer expanse of coins to choose from.

Degens simply need to adapt to narratives with increasingly shorter fuses and get used to riding increasingly rapid orgies of capital and scaling out at lower ceilings each time.

This isn’t to say that memecoins like Fartcoin, SPX 6900, and Pepe can’t run to egregious or absurd valuations in the coming months, it’s just important to recognise that the ultimate bulltardio goal for these coins is likely to be far lower than Dogecoin’s ATH valuation.

Ultimately, we can say that pump.fun has massively and permanently diluted the capital and attention that can be funneled into memes, and it has certainly made the game infinitely harder for trenchers.

But again, it’s overkill to pin the blame for this on pump.fun as a team or as a financial product.

The blame lies solely in the heart of every degenerate max-bidding their chosen dogshit fresh out of bond on the launchpad, hoping to blindly hit the next 10,000X, all while linearly running themselves to zero, instead of just concentrating capital and attention on the market leaders.

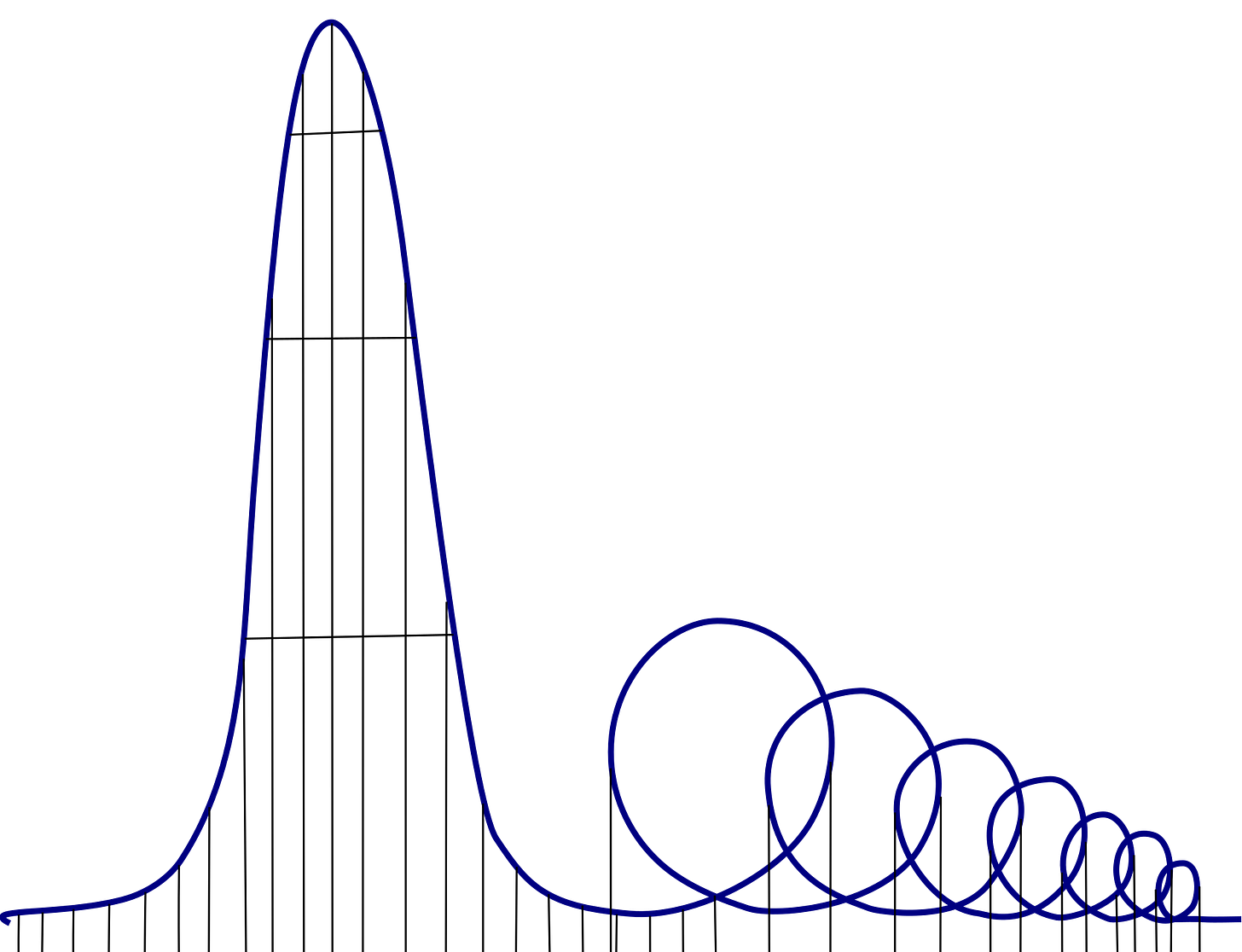

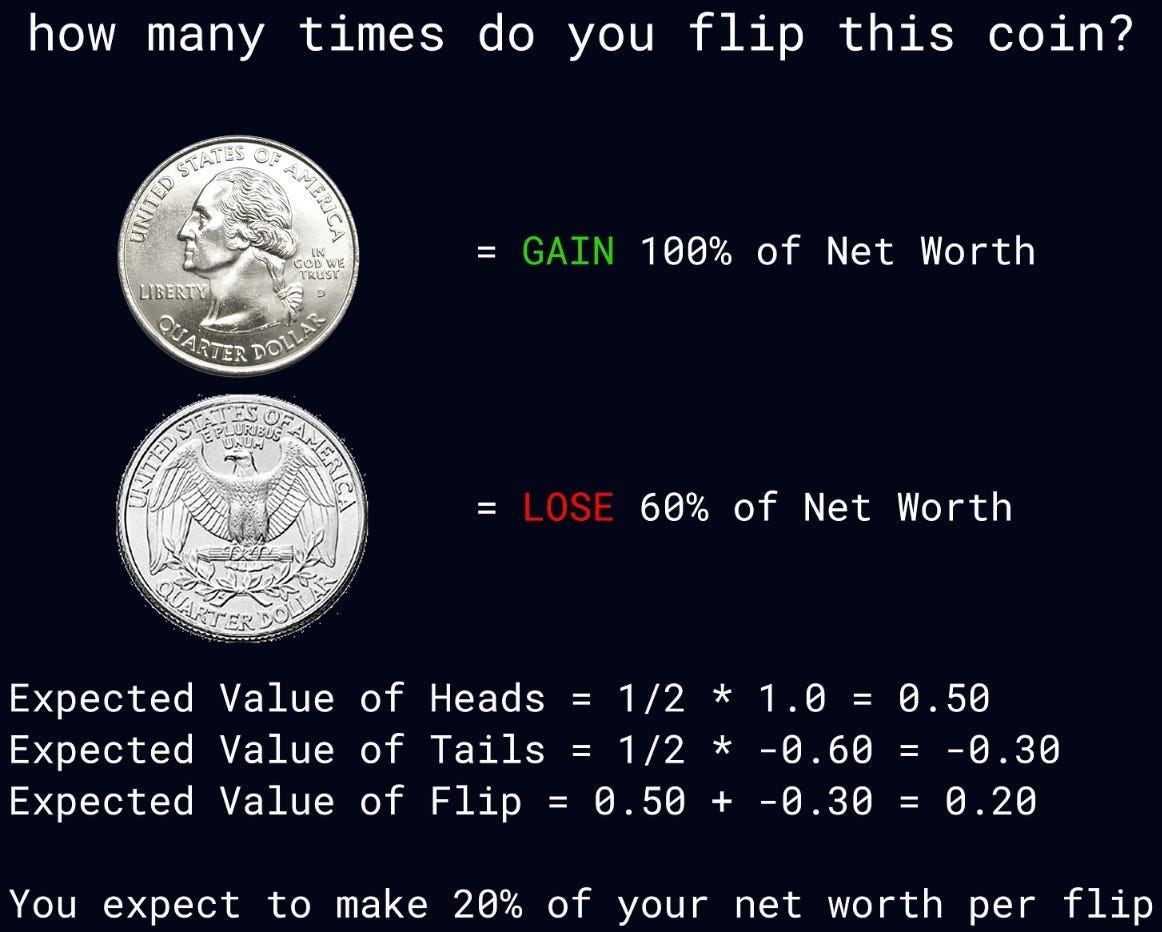

Thiccy said it best in a recent essay titled ‘The Jackpot Age,’ where he breaks down the allure of what appears to be a positively accretive coin flipping game, which is not too dissimilar from the fiendish EV+ allure of hyper-low-cap fresh pairs on a memecoin launchpad.

“The reason almost all outcomes go to zero is because of the multiplicative property of this repeated coin flip. Even though the expected value, aka the arithmetic mean of the game, is positive at a twenty percent gain per flip, the geometric mean is negative, meaning that the coin flip is actually negatively compounding over the long run.”

All of this is to say: the longer one chases seemingly-positive outcomes on a “coin flip” approach to high-risk low-cap investment, the more expeditiously one charts a linear regression to zero.

Moving on from the doom-theses and end result of hypergambling, I want to have a very brief look at the PUMP token and weigh up whether the newly-launched token is a buy, now that it has actually fallen below its TGE price.

PUMP Token & Airdrop

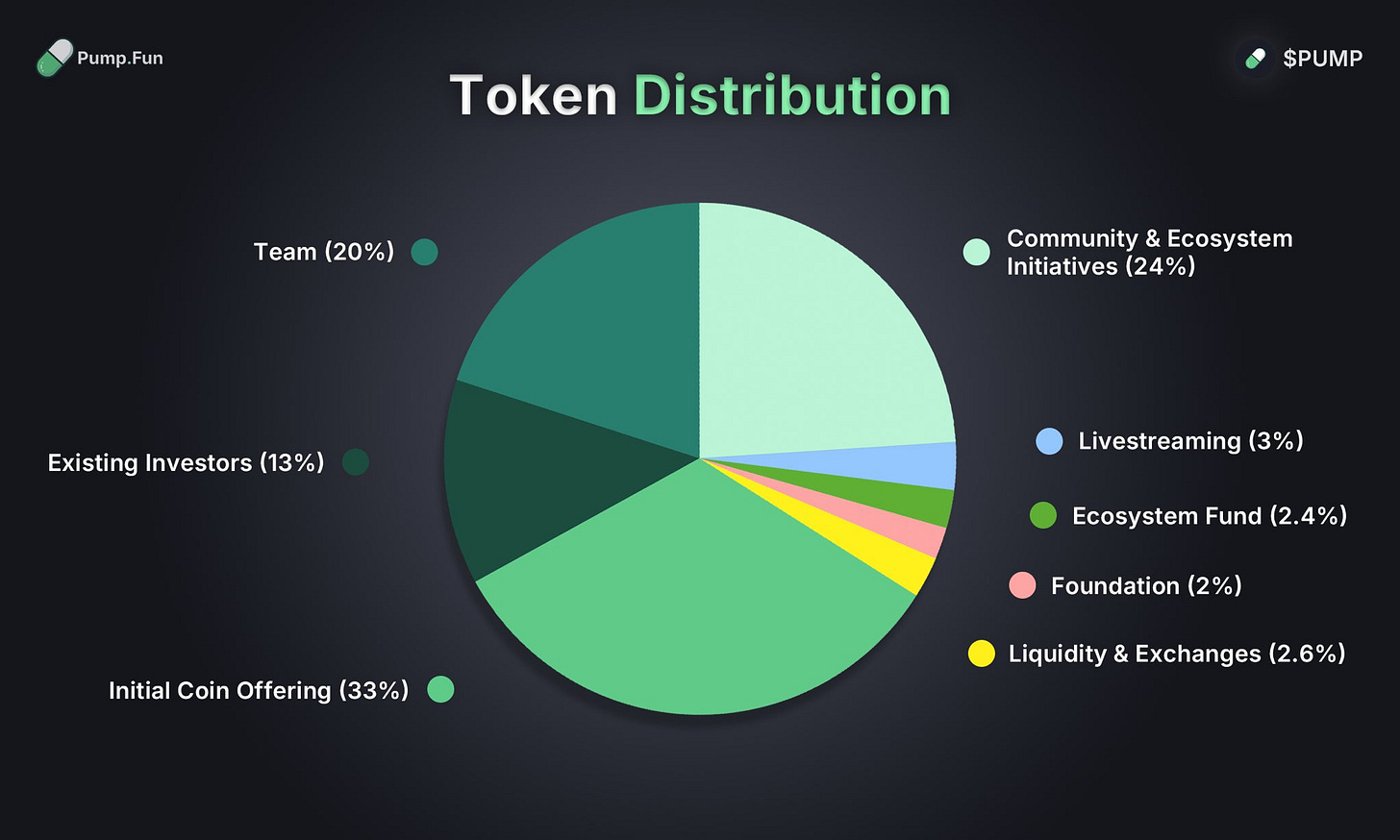

On July 12, Pump.fun launched their native PUMP token. They raised $1B for it via an ICO that sold out in 12 minutes and later TGE’d at a $4B valuation.

The team has been intentionally quiet about the airdrop structure and planned incentives, with no official communications about who is getting what amount of PUMP, when they’re getting or if they’re getting it at all.

One of the only resources we have shows that 24% of PUMP tokens will be distributed back to the “community & ecosystem incentives,” while 3% will go to livestreaming.

Because PUMP is an easy thing to hate, many crypto-natives are either happy to disregard the token, loudly declare that the team has rugged and isn’t doing an airdrop at all, and are now praying that PUMP charts a course to zero.

Wen airdrop? How airdrop?

There are a few things to note with PUMP that make me gently bullish on the token in the long term.

First of all. The team has earned over $700 million in revenue from a platform that literally launches coins. It feels like a directional no-brainer that these guys aren’t going to let their own coin bleed out and die (unless it is just an elabrote multi-billion-dollar exit liquidity vehicle for the team and early investors — in which case, ggwp guys).

Assuming that this isn’t the case, let’s look at some potential avenues for price appreciation.

Buybacks: not great, not awful

The pump.fun team has a specific wallet titled ‘kippahstayson.sol’ from which they’re buying back the token with size.

Following the success of Hyperliquid, people are very quick to see buybacks as the most bullish possible course of action a protocol can take to run up its token.

However, in the absence of other incentives/virtuous flywheels that make market participants want to own the token — like HLP vaults, a value-accretive assistance fund, and a liquidity black of hole of for on-chain perps — buybacks simply add temporary buy pressure, which can be an extremely expensive brand of useless if the rest of the market doesn’t give a shit about the asset.

As of right now, the team has spent $19.5 million buying 3 billion PUMP tokens, which means they are sitting on a ~30% unrealized loss, according to a very handy ASXN Research Dune Dashboard.

They still have $12 million in the team wallet and have begun buying more as of a few hours ago, although the buybacks have waned in size and frequency over time.

Buybacks alone will not be enough to salvage PUMP and send it to new highs.

The team will need to structure a creative airdrop that actually rewards users who drive long-term revenue back to the protocol and incentivizes people to take up new actions.

It’s no secret that pump.fun is facing fierce competition from Bonk.fun, a more community and Solana-focused ecosystem, that is actively working to grab as much of Pump.fun’s market share as it can.

Part of pump.fun’s strategy has already been teased in some of their intentionally vague comments about the future of the protocol, where they claim that the airdrop is “coming soon” and that their platform will “kill Facebook, TikTok, and Twitch.”

I think that the protocol will reward very specific users with a relatively generous airdrop, particularly streamers (like Gainzy and Rasmr), artists like @grizzle_art, and other creators that drive initially less-speculative attention to their platform while still nudging people toward inevitably gambling on shitters (because they earn revenue from fees).

Disclaimer: if you’ve vanished a few SOL through pump.fun and think you’re getting a decent airdrop that will recoup all of your losses, I would suggest putting on some clown make up and laughing at yourself in the mirror.

Ultimately, I think the initial airdrop will be concentrated largely within a small pocket of pump.fun-aligned creators and influencers.

From there, the team will likely encourage inventives by offering the familiar “seasons” approach, where certain amounts of volume, or other user-generated content (UGC) activity, will earn points or some other representation of future PUMP tokens.

Then there’s the more boring stuff like funneling back fees from Pump.fun, and PumpSwap, but that will have to be explained in another post.

Ultimately, there’s good reason to think that the Pump.fun has a plan for the platform that can continue to expand its reach inside and outside of the crypto ecosystem, pending the release of its incentive model to break into more mainstream forms of media.

Many may bemoan Pump.fun and the endless tokenization of content as dystopic or ethically dubious, but I unironically believe that Instagram is far more harmful to humanity than any memecoin launchpad could ever hope to be.

Despite of its shortcomings, whether they be real or imagined, Pump.fun remains an unbelievably compelling project to watch grow (or eventually die).

The future of hyper-gambling will never not be interesting.

Disclaimer: None of this is financial advice. All words contained within this newsletter are my opinions and mine alone. Always do your own research and have the wherewithal (and self-respect) to make your own decisions independently.