Patience — Newsletter #7

The Ethereum ETF will disappoint, memecoins aren't going anywhere, celebrity coins, dimethyltryptamine, NGMI Capital updates and much more.

Bonjour degenerates,

Firstly, I wanted to apologise for the significant delay in releasing the newsletter.

I’ve been having a legitimately awful time relaxing on various beaches throughout the Greek islands and soaking up the European summer in Paris. Please accept this much longer edition of the newsletter as restitution for my extended leave of absence.

ETH’s back on the menu boys

The original version of this newsletter was titled “Ethereum ETF rejection = bullish” — which, in hindsight, was nothing more than an ode to cope where I went to great lengths to justify why a rejection would actually be bullish for ETH over a longer time horizon.

Thankfully, a last-minute change in thinking from everyone’s favourite financial regulator saw the 19-b4 forms for eight Ethereum ETFs being approved in the final innings of the approval process, meaning that we’re really getting an Ethereum ETF.

This may also spell the end of Ethereum being the most cucked asset of this cycle.

Every time ETH moves more than 5% on the day - the rest of the market takes a shit.

We’ll have to wait and see if there’s renewed appetite ahead of the ETF approval, something that seems likely imo.

ETH: still a harder sell than BTC

Despite copping a lot of heat for it, the Bloomberg guys have — rightfully — pointed to some potential issues with an Ethereum ETF, citing a lack of understanding of what Ethereum does on behalf of the traditional investors as reasons for why there could be significantly lower demand when compared to the Bitcoin ETFs.

I know I’m pissing a lot of ETH maxis off here, but the above statement holds weight.

Bitcoin has a very simple, well-established narrative that even the most stone-cold moron could — and can — wrap their head around: Digital Gold™ etc.

Secondly, Bitcoin has already proven itself the strongest, market-leading asset of the last 18 months. I simply don’t see why Ethereum would suddenly become the Wall St darling.

Many of the more vocal Ethereum maximalists correctly claim that the suits will love an asset that allows for tokenisation that also comes with a relatively risk-free native yield.

Ironically, I think this exact value prop is its weakness in the minds of TradFi noobs who haven’t yet come around to accepting the ultimate and glorious paradigm of cryptographically-secured networks or world computers.

While crypto-natives already “get it’” and rightfully believe that suits will fucking love ETH, I think it will take our coke-snorting, whiskey-swilling brethren in traditional finance brethren a little while longer to wrap their heads around the idea of native yield and revenues stemming from something as spooky as cryptocurrency.

[insert meme of normie guy in Patagonia vest holding coffee cup saying something about P/E ratios + EBITDA + risk-adjusted returns]

With that said, there seem to be plenty of early green flags for institutional appetite for Ethereum ETFs already. Lots of good derivatives activity with serious buyers throwing considerable sums at $4k ETH calls expiring in December.

So to sum up this confusing rant — I think the ETH ETF will be initially quite underwhelming (when compared to the Bitcoin ETF launch) but clearly long-term value accretive.

To clarify, I remain an ETH maxi and I’d be happy if I was proven wrong on the above points. I just don’t think Ethereum has shown enough relative strength in the last 18 months for me to back the turbo bull ETH case.

Final Prediction: BTC continues to dominate the scene in terms of institutional adoption and provides outsized returns relative to ETH.

Celebrity coins

I prefer to remain low neuroticism when it comes to pointless drama regarding something as trivial as “celebrity coins.” With this in mind, we’ll be approaching this from a purely cold and unfeeling standpoint.

One of the key arguments in favour of celebrity coins has been helping “famous” people learn about crypto because of something about ‘muH m4sS aDopti0n.’

Please enjoy the following counterpoints to this blatant clout-addled lunacy:

Be incredibly sceptical of anyone saying you — a bonafide ordinary pleb on the internet — should be sympathetic to the plight of washed-up grifters and narcissists. Anyone touting this kinda of garbage has a strong financial/social incentive to be saying so.

Anyone that’s truly interested in learning about crypto can lurk on Twitter and lose gut-wrenching sums of money in the brutal and unforgiving free market for a few months like the rest of us did.

You don’t “get into crypto” by launching a fucking coin. I’ve been in crypto for three years and not once has the thought “hmmm maybe I should launch a coin” come to mind as a method for educating myself about cryptocurrency.

TLDR: Celebrity coins are a mechanism that transfers your money to the pockets of has-been parasites. Do not, under any circumstances, give it to them.

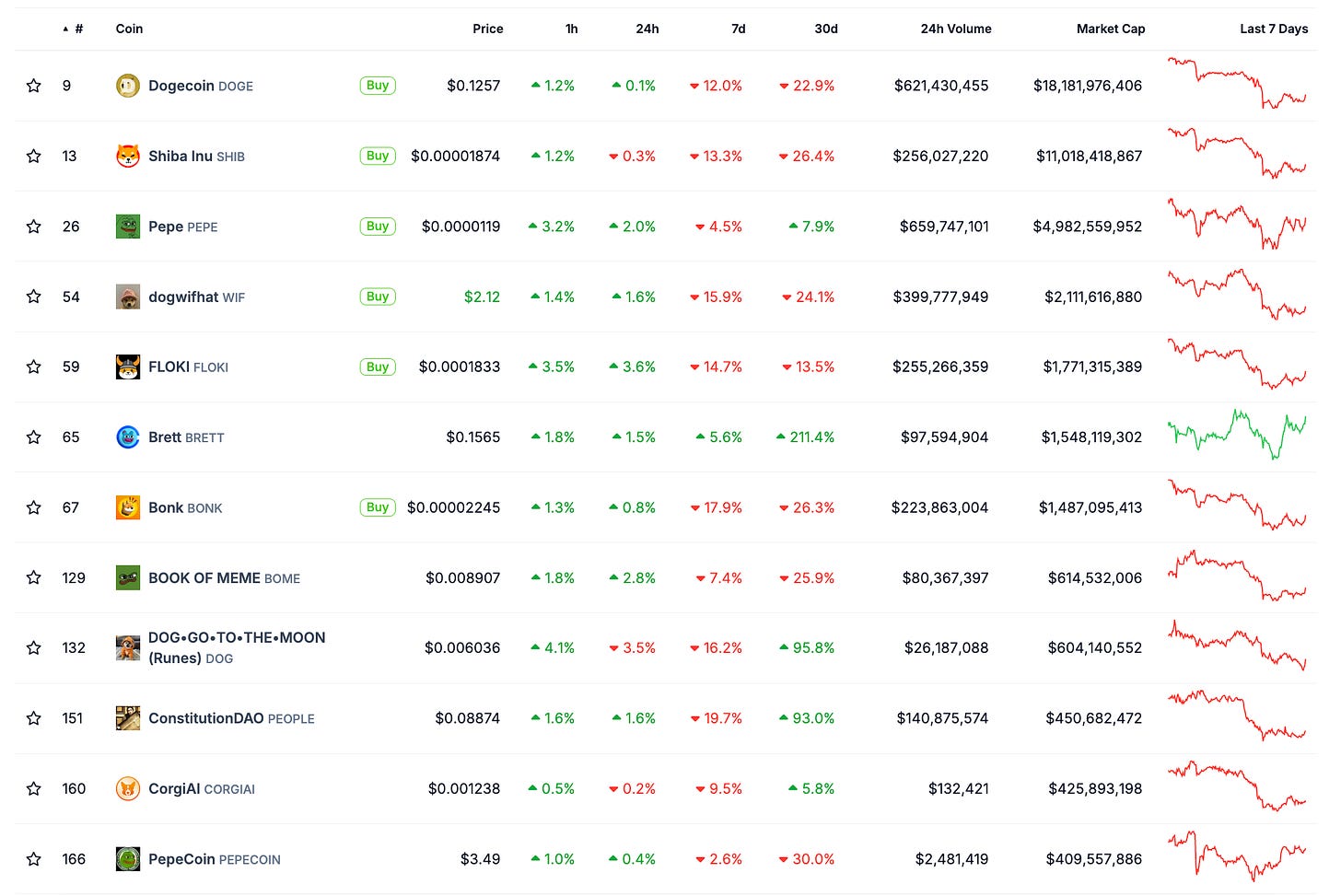

Memecoins look rough

After practically carrying much of the current bull market, memecoins have taken what some would call a little breather.

I tend not to think in absolutes and divide my thinking up into bull case vs bear case.

Overall, I think memecoins are a reflection of the following mentality:

“eh - crypto is already a giant ponzi, why don’t we just send the most stupid shit to absurd valuations and make a fuckload of money along the way?”

As macabre as that is to admit, that’s where many market participants appear to be at this cycle — with much of the new predatory, high-FDV VC coins nuking all of the opportunity for the average retail participant to make multiples on their initial principal.

Couple this with the feeling amongst younger people that the world simply isn’t working in favour of their financial freedom and you have the perfect recipe for a tasty dish of: “impulsively risk caital to earn money and beat the system that is unfairly titled against me.”

In this sense, memecoins are akin to a punk movement amongst financial speculators on the internet.

However, as much as I personally enjoy degenerate gambling on shitcoins (and justifying it as a countercultural movement) — it’s important to remember that memecoins are the financial equivalent of a Mexican standoff.

Once enough people start shooting, it’s game over.

The only pseudo-exceptions to this are things like DOGE and SHIB which grow out of the value of their communities. We’re yet to see if new Solana entrants like Dogwifhat or Popcat can pull this off.

Memes: up or down?

TLDR: memecoins aren’t going anywhere anytime soon.

So long as there’s a pervasive and felt sense of financial inequality in a world where stuff becomes increasingly expensive, speculators will keep funnelling their cash into memes in the hope of beating the system.

Because all the major chains have such heavy beta attached to them, memes will continue to be the best beta to majors.

Observe the price action of Pepe relative to Arbitrum, Optimism and Lido on Ethereum in the coming months and you’ll see what I’m on about.

NGMI Capital Updates

The CIO of NGMI has been enjoying some much-needed downtime, soaking up the sunlight in the north of France, Santorini and Milos, as well as playing a hideous amount of Pokemon.

While the CIO didn’t undertake much in the way of new trades over the last few weeks, the thesis on one of his most dearest-held bags has been proving itself true in the form of outperformance relative to the rest of the market.

Smoke DMT

Dream Machine Token (DMT) the native token of the Sanko ecosystem is something I first wrote about back in February, when the price was somewhere around the $40 mark.

The CIO first bought DMT in August last year (he bought the range pico top at $55). However, he secured his largest entry at $11 and has topped up along the way with more size, with the highest entry being somewhere within spitting distance of $80.

Everyone on the timeline is miserable, bogged down by filthy VC chains that are quite literally designed to dupe retail into buying their bags that have already pulled a 100X.

DMT is one of the rare new tokens of this cycle that was fairly launched by a small crypto-native team at a more than reasonable valuation, a working suite of technical products including games, an entire streaming platform as well as a newly-launched Layer3 network called SankoChain.

The newest game is called Sanko Pets, which apart from having a nostalgic 90s vibe and genuinely engaging Tamagotchi-style gameplay, also unlocks the ability to stake DMT to earn in-game currency called Gold.

Oh yeah, and SankoChain has a thriving market of new shitcoins to gamble on. This is, without a doubt, the most slept-on crypto-native project of the current cycle.

It also comes complete an eclectic crew of profoundly redacted holders who will not sell until disgusting valuations have been achieved. Bullish.

Infinex

The CIO chucked a few K of stables into Infinex as part of their Speedrun the Waitlist campaign.

This wasn’t enough to earn enough points to purchase one of the patron NFTs, but it’s the CIO’s belief that the points earned — dubbed “GP” — should trade at reasonable prices following the release of their NFTs as bigger farmers scramble to grab as many of these NFTs as possible.

launched by the Australian chads behind Synthetix, Infinex is calling itself the “UX Layer” — a platform that will eventually consolidate the hundreds of different crypto apps in a single place, allowing users to access crypto without the need for seed phrases.

Beyond the purely short-term, point-farming aspect, the CIO really likes Infinex as a product. Having a central place to store one’s crypto securely while navigating the hundred+ different crypto apps seems like a no-brainer for any crypto user.

Sanctum

Season one on Sanctum, a liquid staking platform for Solana, has wrapped up. The CIO has nabbed himself a spot among the top 2,800 point enjoyoors — which will hopefully yield a profitable airdrop.

As far as points for airdrop point-earning programs go, Sanctum has proven itself to be one of the best in recent memory, especially on Solana (invoking MarginFi hatred here).

The Sanctum team has been super transparent about the upcoming token-generation event for the native CLOUD token. Usually, this isn’t cause for celebration but following the absolute shit show of airdrops in recent months, this is a certified masterclass in handling press ahead of a token drop.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do.

All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.