It's Really That Easy — Newsletter #6

Staying bullish despite miserable chopsolidation, white-knuckling putrid dips, airdrop farming chicanery, NGMI Capital updates and more.

There are many reasons to remain bullish in the face of nearly three weeks of ‘chopsolidation.’

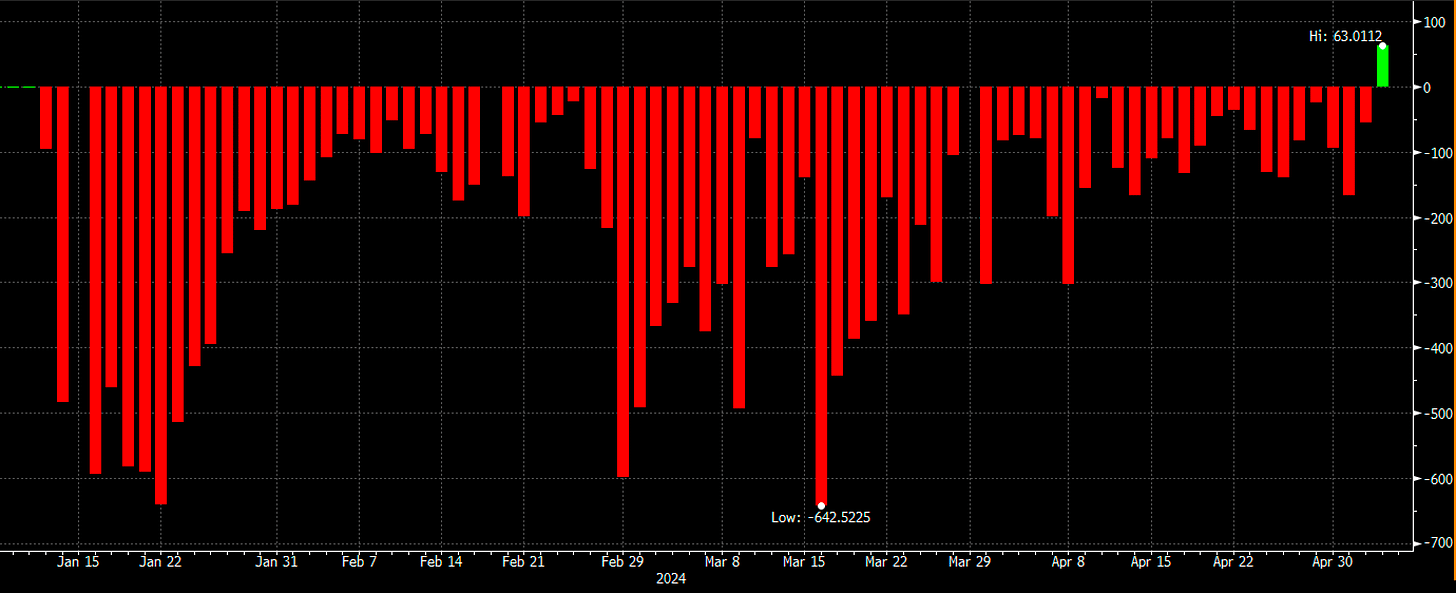

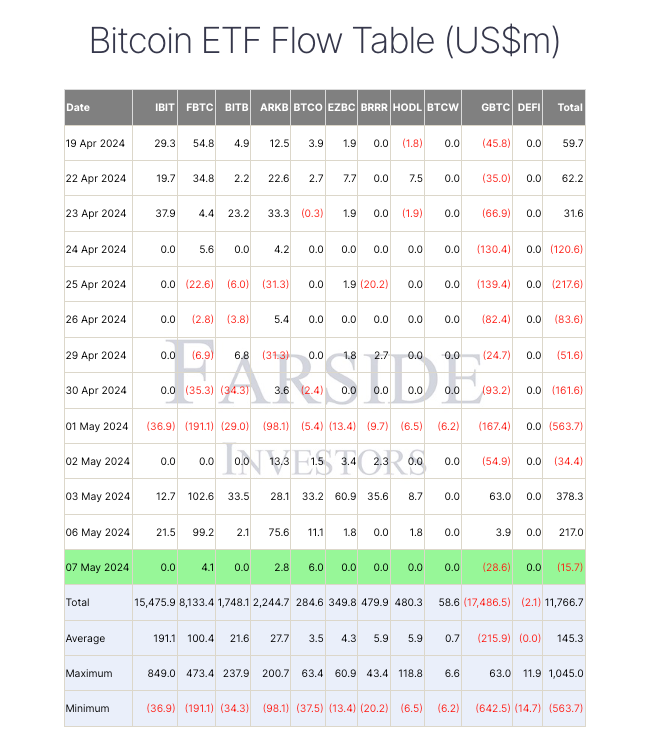

The first is demand for spot Bitcoin ETFs is still very much present and the new holders seem to have made peace with volatility.

The vast majority (95%) of the new Bitcoin ETF buyers (excluding paper-handed GBTC shareholders) held through what ETF analyst Eric Balchunas described as a “pretty nasty and persistent downturn.”

Friday was the first day that all eleven Bitcoin ETFs posted positive inflows since their inception back in January — the HoF level of which is painted nicely below.

I swear I say this every few days but ETF inflows are not catalysts for price action. They should be viewed more as backstops (something that places a sturdier floor below the overall price action).

They are also an extremely good barometer of market sentiment and gauge of general institutional interest in BTC.

Additionally, we also saw a net inflow into GBTC for the first time ever, with $66.9 million of new capital heading into the fund. The fact that anyone is braindead enough to bid GBTC is immediate confirmation that we are going so much higher from here.

I strongly believe we’re about to see another prolonged period of based institutional gigachads dedicating a good amount of their time and capital to flow-maxxing the living fuck out of these products.

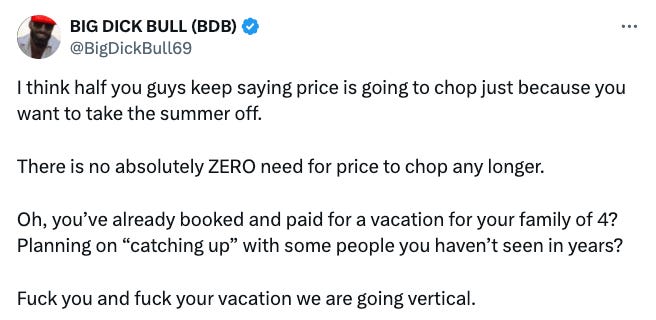

With that said, I think we can still wallow in this range of boring and slightly painful chop for another week or so at least. Following that the course to $80k BTC is pretty much preordained.

Although I’m torn between a slightly cautious stance and that of perma-bull BDB — who rightly said there’s quite literally zero reason price can’t go vertical immediately.

In short, I really don’t think we’re close to the cycle being over. Not even close to be entirely honest.

All that’s left to do at this point is keep adding to strong core positions, not overtrade and don’t sell shit too early because charts look ugly for a few days.

It’s really that easy.

White-knuckling the right coins

Due to conditions still being firmly in the domain of player-versus-player (PVP) — and still being subject to brutal rotations — the tide is not yet lifting all boats.

I have personally struggled to execute on rotations plays, partly because I’m a low IQ journalist but mostly because they’re really not hyper-profitable unless you have a considerable amount of capital to throw into it or use large amounts of leverage on a small stack.

While outflows and "bad price” price action (PA) took over, you’ll notice that the broader market sentiment oscillated viciously between “it’s so over” and “we’re so back” — oftentimes on a daily basis.

While it can be fun to lean into the game of PA-based bipolarity that pundits on Twitter seem to be prone to — if you’re actually letting your emotions be dictated based on day-to-day inflows of spot ETF products and general market movements, it may be a good signal that you need to embrace a more removed approach to managing your portfolio.

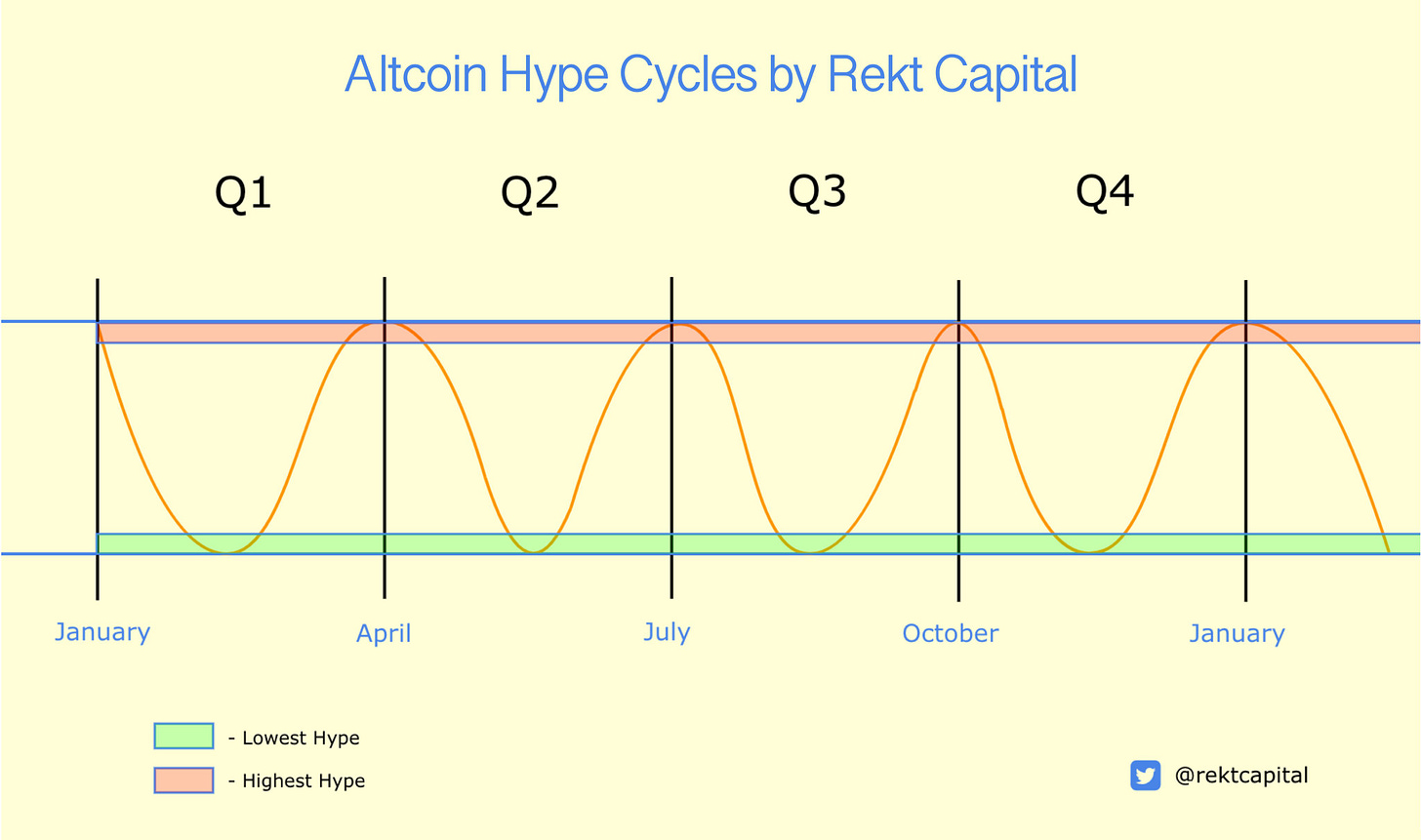

It’s also worth noting that altcoins — particularly memecoins — are subject to the

A very simple diagram (which excludes Y-axis price appreciation noise) paints a very clear picture of what the majority of alts are doing at the moment.

I prefer to hold high-conviction spot bags and just white knuckle the dips.

Only when it is ‘so over’ can we be ‘so back.’

As price gets higher people get increasingly attached to “how much money they had” a few weeks prior, making the pain of dips greater and making them feel foolish for not selling.

The only reason to sell a bag is if there’s new information that decimates the original thesis of that investment. If you’re looking at selling simply because “price looks bad man” then you need to step away from your trading devices and reassess what it is you’re hoping to achieve with your positions.

If someone were to invent a quantum computer capable of hacking blockchains, or a capital city were to be nuked by a foreign power sometime later this week — only then would I consider selling any of my core holdings in a single clip.

Lessons from Memecoins

This week I spoke with Colton Kirkpatrick — the founder of Solana memecoin ZynCoin — about the impending memecoin supercycle, the behind-the-scenes of launching a $150 million marketcap memecoin, God, ultrarunning, AI and a whole lot more.

I can’t really put the whole discussion into a few words — so just go and check it out.

NGMI Capital Updates

Currently, the CIO holds the bulk of the NGMI Capital portfolio in Solana (thanks to a nice meme season) but he is looking to rotate into positions that have more upside than just holding a huge chunk of SOL.

Assuming a somewhat irrational price target of $1000 that still only puts maximum upside at ~6X from current levels (accounting for laddered exits later on in the cycle).

These may be famous last words, but the CIO is not all that interested in a meagre 6X. If he wanted returns like that he’d go over to TradFi and buy bonds or T-Bills.

Farms of the week

Stemming from this boredom with just holding raw SOL, the CIO has taken many of his precious Solana tokens from their idle point-farming status on the most accursed lending protocol (also known as MarginFi) to farm a new “infinite” liquid staking platform called Sanctum in hopes of landing himself a sizeable airdrussy.

Sanctum

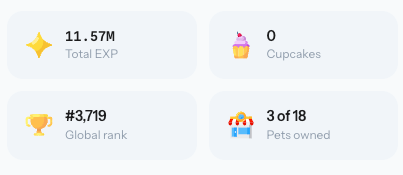

NGMI Capital has begun agricultural operations on Sanctum with roughly 200 SOL split across two main wallets.

Historically, the CIO preferred to farm airdrops with relatively small size across multiple wallets, but then was when he was considerably poorer. Now he’s seeing what hitting a farming strategy with actual size can yield.

NGMI Capital is currently sitting in the top 3,800 holders on Sanctum and counting.

If any readers also feel like farming Sanctum they can use the CIO’s Ref Link.

Disclaimer: Note that Sanctum is a relatively new liquid staking layer and comes with all of the usual risks that accompany Liquid Staking Token (LSTs) platforms: including de-pegging of the native LSTs as well as the protocol itself being hacked.

Sanctum Farming To-Do:

Swap SOL to INF on Sanctum

Lend that INF back to MarginFi or Kamino for extra points on Sanctum while still farming points on the lending protocol as well (its kind of a win-win).

Wait for Sanctum token.

MilkyWay (Celestia)

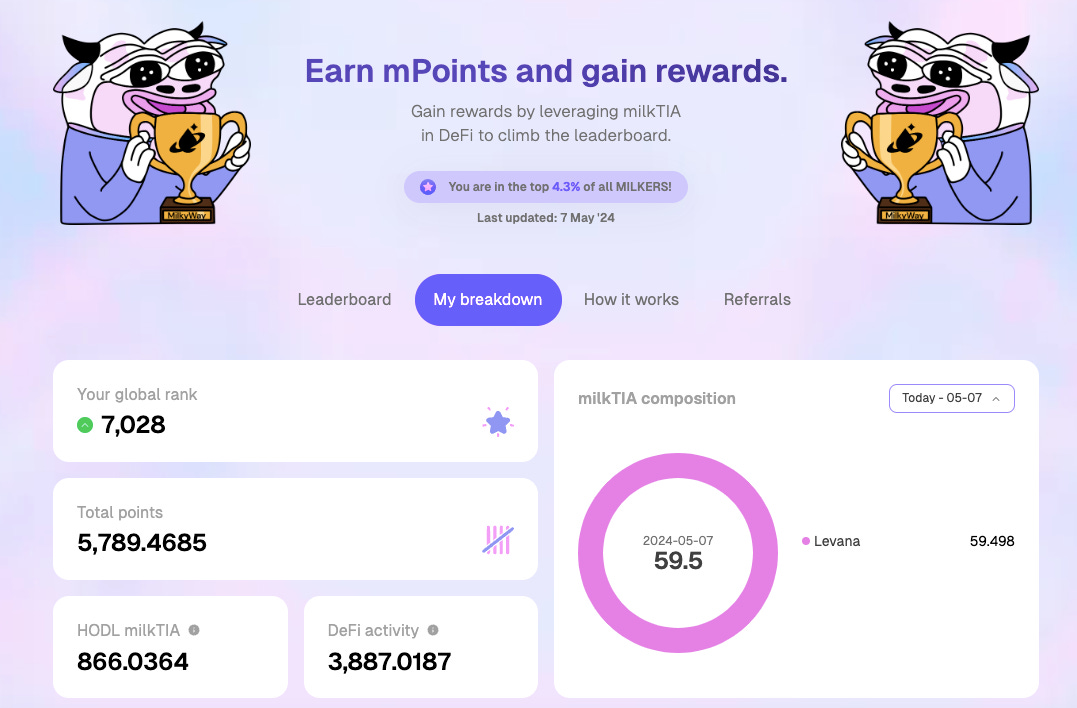

NGMI Capital was relatively early to Celestia (TIA) and hasn’t bought any additional TIA over a price of $11.

Initially, the CIO was staking all of the TIA tokens directly on Celestia validators but decided that the liquid staking platform MilkyWay was probably a better option for TIA because it doesn’t enforce a fourteen-day lock-up period like regular staking.

The CIO doesn’t have enough TIA to be worried about it, so he has dedicated the majority of his holdings to MilkyWay.

Much like Sanctum, you can earn additional points by taking the new milkTIA liquid staking token and looping into DeFi protocols like Levana or Demex.

I’m aware that Stride also exists as a platform for liquid staking TIA but I have a hunch that MilkyWay will yield a bigger eventual airdrop.

Portfolio

The CIO is currently holding personal long-term positions in the following coins. (These are listed by order of approximate weight)

Solana (SOL)

Popcat (POPCAT)

Ethereum (ETH)

Bitcoin (BTC)

Dream Machine Token (DMT)

Celestia (TIA)

Pendle (PENDLE)

Dymension (DYM)

Creso Wallet (CRE)

Pyth Network (PYTH)

Prime (PRIME)

Stacks (STX)

Vector Reserve (VEC)

Positions are roughly in order of weight. One day the CIO will get around to organizing this better. But not today.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do. All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.