Haha Pseudo AI Coins Go Brrrrrr

Artificial intelligence just sent crypto into overdrive, but where are the fundamentals?

Artificial intelligence seems to have overtaken every waking moment of the public consciousness. Every day the headlines of all the major news outlet are dominated by stories of OpenAI’s wonder-bot ChatGPT acing exams from Wharton Business School, and even landing high-paying entry-level jobs at what should technically be its competitor, Google.

After remaining worrying silent for months, while ChatGPT was shattering new records for user growth, Google yesterday announced the launch of its own chatbot ‘Bard’. The name could use some work, but apparently it will be available for public use in a matter of weeks.

How Google will deal with the founders dilemma introduced by Bard is yet to be seen.

Crypto’s got it bad for AI.

Cryptocurrency, ever the focal point of degenerate speculation has taken the new investment thesis: “AI = fucking awesome” and sprinted off with it.

While the broader the crypto market has been enjoying a significant surge upwards, a AI-adjacent cryptocurrencies have been quietly outperforming the rest of the market by a huge margin. This was until their spectacular gains hit the mainstream, causing everyone to ape into them in FOMO-fuelled frenzy.

Less than two months ago, there would have been around 9 people in crypto capable of naming a single “AI token”. Today, the tickers AGIX, FET, DBC & are on everyone’s lips.

There’s one thing in particular about this rally is that poses a serious threat to investors jumping onto the last carriages of this hype train: most of these tokens don’t really do anything…

Here’s a super quick run through of all the biggest AI tokens and a little insight into what purpose they actually serve.

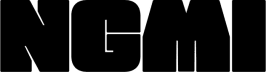

Fetch AI ($FET)

One of the biggest gainers in the AI-induced buying frenzy has been Fetch.AI, which honestly is probably the only one of these tokens with an established use-case and legitimate base of clients (as well as a website that actually works lmao).

Put simply, Fetch is a blockchain network that connects and secures data networks through the use of what it calls “autonomous AI”.

By joining together big old datasets it optimises DeFi trading platforms, transportation networks like parking and traffic, as well as things like smart energy grids. Basically any super-complex digital system that relies on massive datasets can leverage Fetch AI for optimisation, which by all accounts it actually does.

Fetch AI’s FET token has pumped a very respectable 480% from the beginning of this year and currently sits at just above the $0.50 price point. While investors should expect a steep pullback in the coming days, Fetch seems to be one of the only AI tokens that actually has some real world fundamentals at its core.

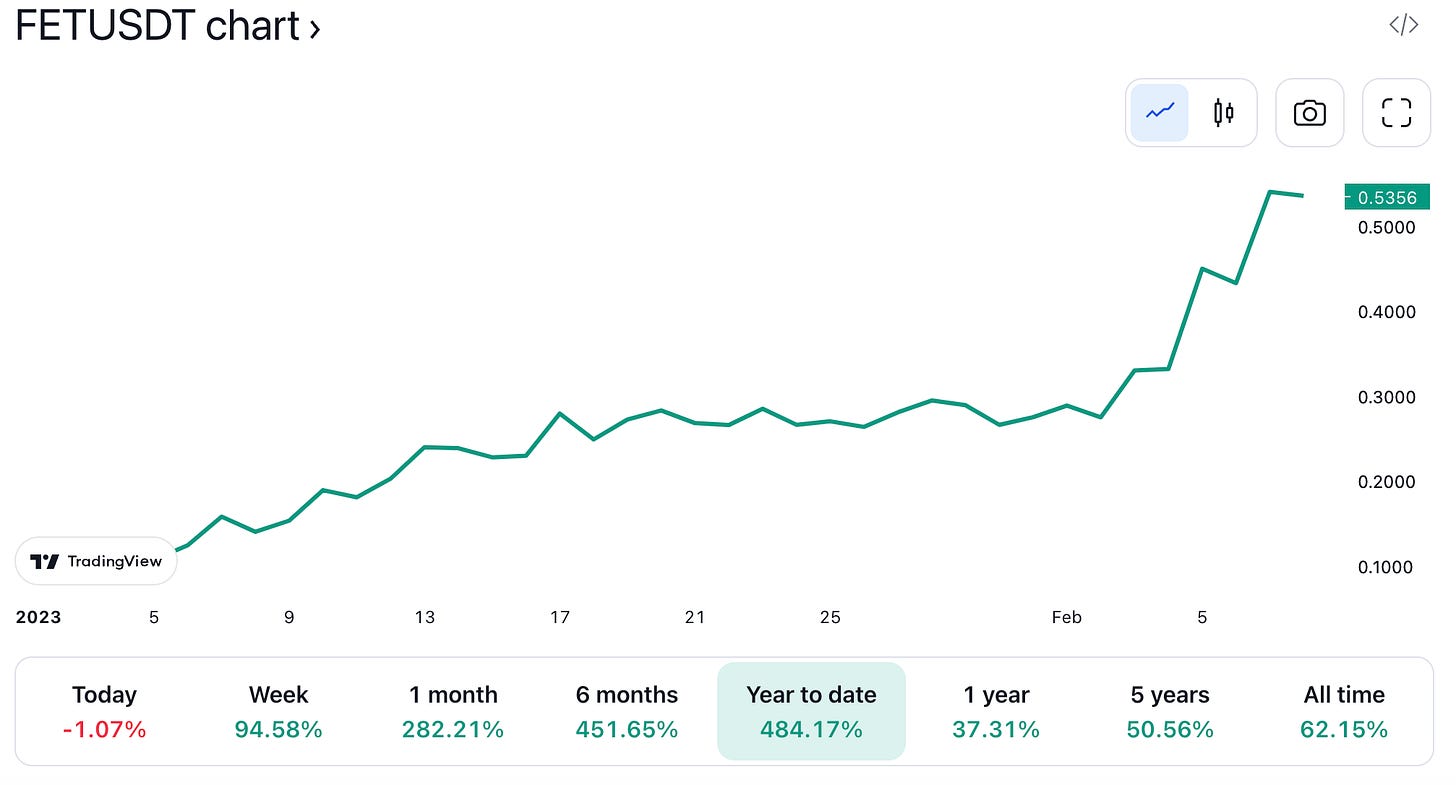

SingularityNET ($AGIX)

Next on the ol’ list is SingularityNET, which goes by the ticker AGIX. To be completely honest I don’t actually know what to make of this one. It feels like vapourware and it certainly smells like vapourware but I don’t feel confident enough to go right ahead and blast it’s reputation to smithereens.

SingularityNET markets itself as a blockchain-powered artificial intelligence marketplace where anyone can “create, share, and monetise” AI services.

With all of this in being said, its’ website is incredibly amateur and it makes me seriously question whether or not any “AI services” are actually being bought and sold. It remains entirely unclear as to what kind of services —if any — anyone would actually be purchasing on the platform.

To summarise, it seems to be an underwhelming project that was extremely well-positioned to capitalise on the AI hype coursing through the veins of the crypto market, which it’s done quite well, posting a staggering 1,182% gain since the start of this year.

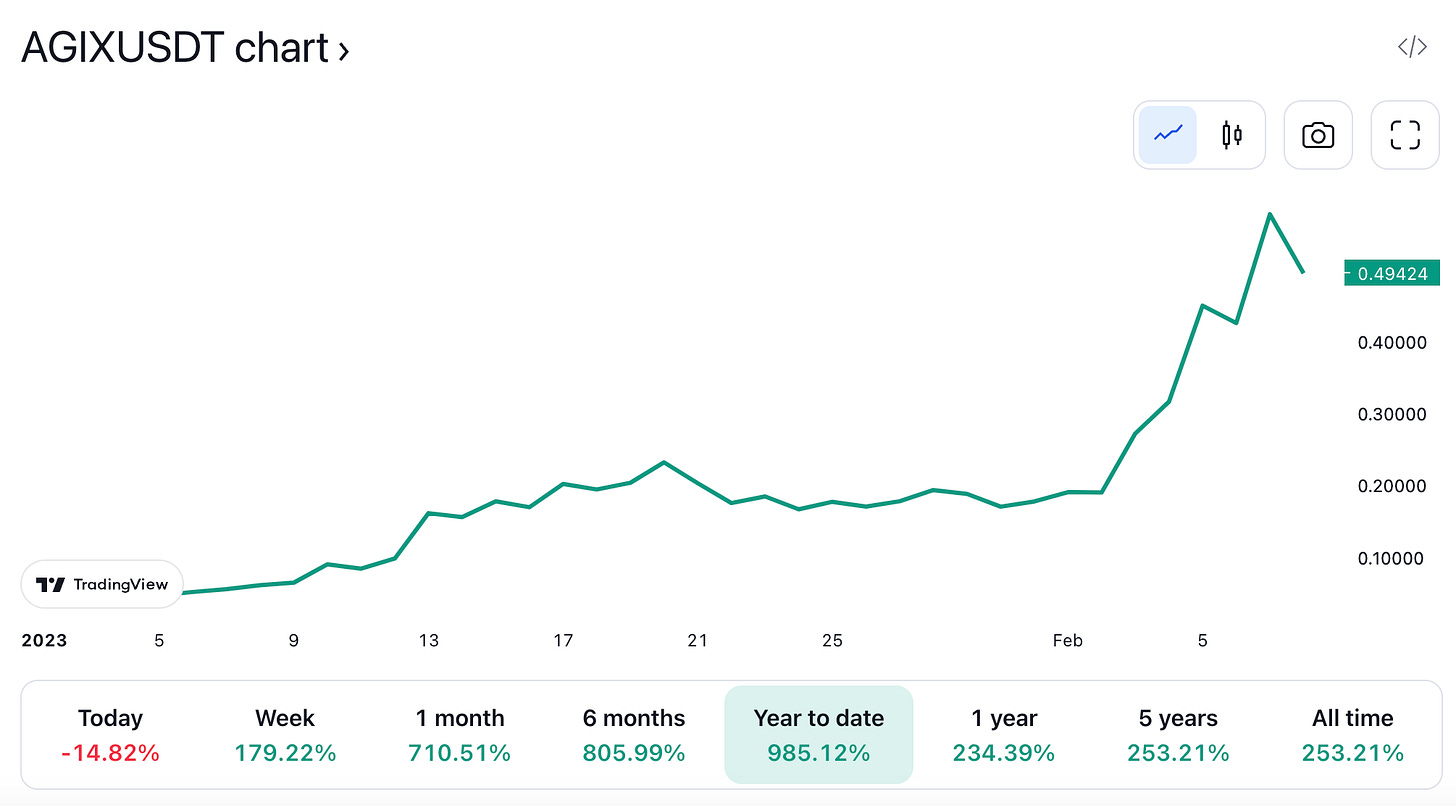

DeepBrain Chain ($DBC)

Also making an appearance on the AI token billboard is the old microcap throwback DeepBrain Chain. First launched in 2018, this bad boy surged on arrival and then dropped 99% for the next 3 years and stayed there. However, as of January 1 this year its native token ‘DBC’ has posted a whopping 820% gain over the last 39 days.

DeepBrain Chain markets itself as a blockchain-based business that reduces the cost of running AI utilities, making them more affordable for businesses. DeepBrain Chain has already (supposedly) been utilised by a number of businesses to assist in the development of cloud-based games and engineering simulations.

At the end of the day, DeepBrain Chain is yet another curious example of what can be called a pseudo AI token that offers very little in the way of real utility.

It’s also worth noting that DeepBrain Chain remains down more than 98% from its all time high of US$0.66 which it reached all the way back in 2018.

Artificial Liquid Intelligence ($ALI)

Artificial liquid intelligence has been the second-best performer in the AI frenzy, biggest ALI token has booming a very respectable 987% YTD. ALI kicked the year at a price of just US$0.008 and grew to a new yearly high of US$0.087 which it reached yesterday.

For those of you reading along wondering exactly what Artificial Liquid Intelligence does, it’s kind of hard to break down exactly this token does but here goes.

ALI is the native token of ‘Alethea AI’ a company working on what a decentralised blockchain-based protocol that will create what it calls an “Intelligent Metaverse”, set to be inhabited by interactive and intelligent NFTs, dubbed ‘iNFTs’. It seems to be slightly more reputable than DBC and AGIX but I’m not sold that it’s worth its $272 million valuation.

Ocean Protocol ($OCEAN)

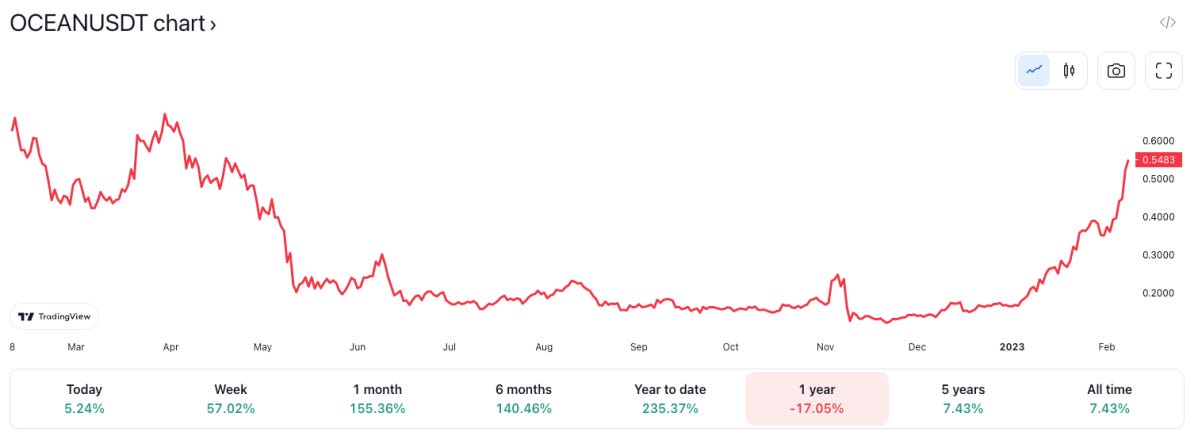

Easily the most mysterious of the AI tokens doing the rounds is Ocean Protocol whose aptly named native token ‘OCEAN’ surged just under 250% YTD.

What stuns me most about Ocean Protocol is that its listed amongst all the other AI tokens and yet there’s little to no evidence of it even using artificial intelligence tech at all. It’s almost impossible to figure out how it really works or what its relationship to artificial intelligence technology is.

However, the simplest explanation is that Ocean Protocol allows people to monetise their data while preserving privacy and control over said data.

Where Big Tech companies vacuum up user data and sell it in secret, Ocean Protocol (supposedly) allows for users to select which data is purchased and find unique datasets that were typically hidden from view. Data can be browsed on the Ocean Market, which serves as a marketplace for data owners and buyers to buy, sell, or trade data assets in a secure manner.

As of right now Ocean Protocol is down a little more than 70% from its all time high, which it reached nearly 2 years ago on April 10, 2021.

Are AI tokens worth it?

It should go without saying but FOMO is not an investment strategy, and the fact that we’ve already seen 1000%+ gains across the board probably means that those jumping in right now are about to become someone else’s exit liquidity.

All investments in cryptocurrencies whose intended function is what can only be described as “a little hazy” should be approached with an extreme dose of caution and even higher dose of scepticism.

Literally every last one of these tokens was unknown to the bulk of the broader crypto ecosystem before ChatGPT ever came along, and the silence from investors when asked what this “AI tokens” actually do is deafening.

If you enjoyed reading this or found it valuable, feel free to subscribe.

Otherwise you’re putting yourself at risk of catching a serious case of ngmi.