Edging - NGMI Newsletter #9

Price action teasing, the end of free money, gaining an ‘edge’ on the market, NGMI Capital Updates and more.

This hefty and long-awaited edition of the NGMI Newsletter will focus on “edging” as it relates to the internet coin market for the last 7 months and the rest will look at what getting an edge on the market looks like from my own completely redacted perspective.

But before we get stuck into that let’s go over all the big stuff that’s happened in the last month.

Rate cuts

JPowell went big with a 50bps slash.

Because there are already 100+ other nerds with a substack poring over the minutia of today’s Fed decision — I really won’t try to read into the macro shit too much.

Rate cuts mean cheaper money.

More money = more risk.

Don’t overthink it.

It’s a good thing.

Nvidia: pseudo-strong but good enough

NVIDIA came out with relatively strong earnings last fortnight and the market’s response was not what I would call encouraging.

The chipmaker posted a 122% increase in revenue for the quarter but still sliced about $200 billion off its market cap in the hours following its release.

The market is so chronically addicted to Nvidia walloping its earnings out of the park that any time it doesn’t come in way over expectations, it becomes a “shit the bed” moment for speculators.

While many will make the case that Nvidia’s earnings slip is a sure-fire way of declaring the stock and the other top QQQ contenders overheated — I don’t think this is necessarily the case at all.

We’re simply seeing Nvidia be sold off and then risk re-positioned across smaller caps. With today’s rate cuts, Nvidia’s earnings sell-off reads to me like profit taking so there’s more capital to move further down the risk curve, which is very good news for cryptographically-secured tokens.

Observe the little circle on the Russell 2000 Index (Futures* bc the chart is the nicest) below: it’s called re-allocating to small caps.

Bitcoin

While we’re still on the topic of edging — Bitcoin and the rest of the crypto market’s price action has been a verifiable tease since late March.

We’ve rejected every push above the $69k-70k level after BTC broke new ATHs on March 13.

In the last few months, we’ve seen a lot of bearish sentiment stemming from hefty BTC sales, namely from the German government and creditors of the collapsed Japanese Mt. Gox.

Germany dumped around $3 billion worth of Bitcoin directly on the market last month and surprisingly little negative price action occurred.

Fears were provoked, beartards posted their typical sub-20 IQ point fear porn and at the end of the day — the dips were gloriously slurped by risk-on chads and we’ve held a fairly stable, compressed range despite all of this “bad” news.

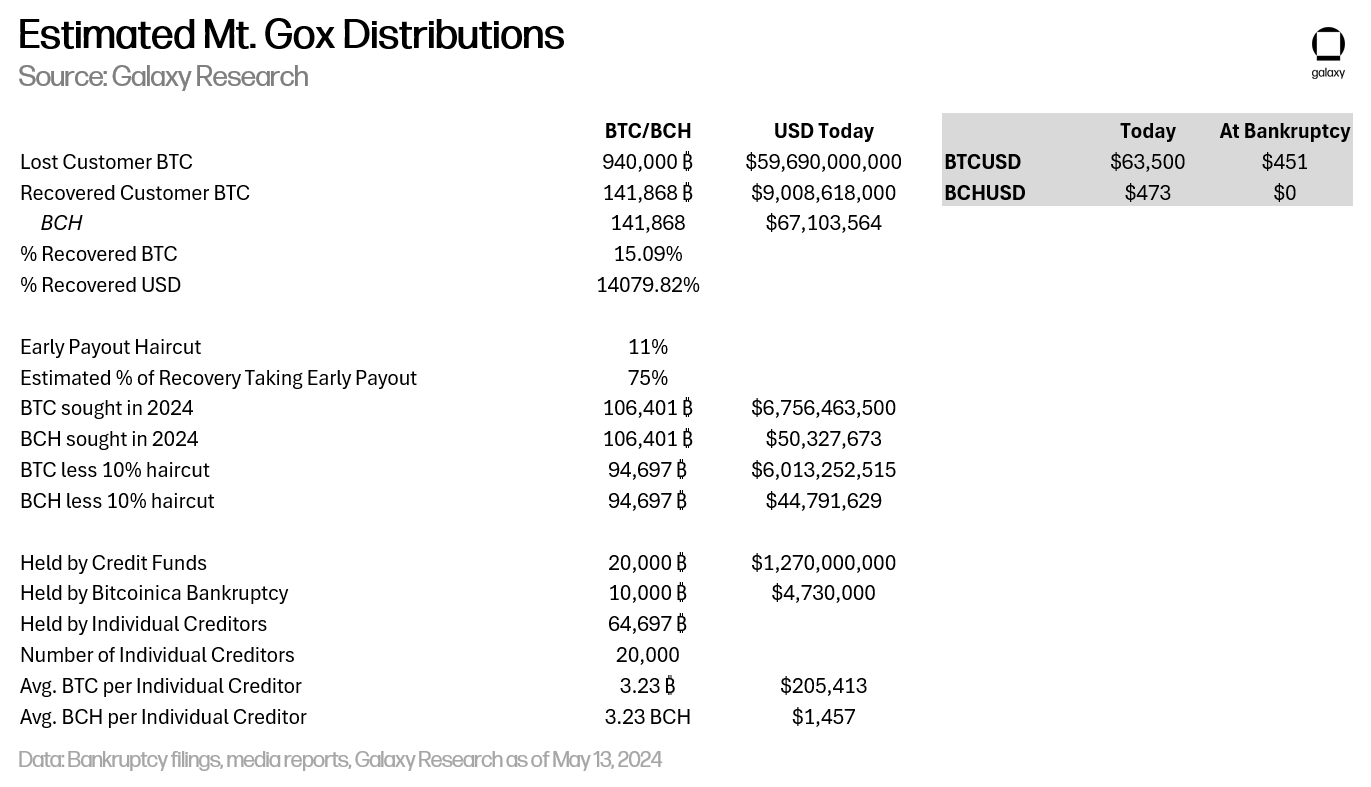

More recently, everyone then turned their attention to Mt. Gox — which is almost done with distributing roughly ~$10 billion in straight BTC (and $73 million in Bitcoin Cash lmao) to creditors who lost their funds during the infamous Mt Gox hack in 2014.

Mt. Gox: a confirmed nothing burger

Alex Thorn, Galaxy Digital’s Head of Research put out an extremely good post on this about a month ago.

Of the 141,868 BTC ($10 billion) that’s being paid back to creditors in the next month, only 65,000 of it will be going back to individual creditors — who are the ones we have to genuinely worry about just raw-dogging it straight into market orders.

In short, Thorne says that while technically ~$9 billion BTC is being paid back to creditors, only $3.5 billion looks like it actually ended up on the market.

TLDR: the anticipatory negative sentiment drummed up by market-wide fear during these events is worse than the actual price action induced by actual spot selling.

Ethereum: pls do something

I’ve said on multiple occasions that gaining increased exposure to ETH during this (now extremely prolonged) phase of miserable price action feels like a brain-dead easy trade.

Unfortunately for myself and any other fellow Ethereum enjoyoors, the performance of this token has found me on multiple occasions staring in the mirror at odd hours of the early morning questioning my own sanity.

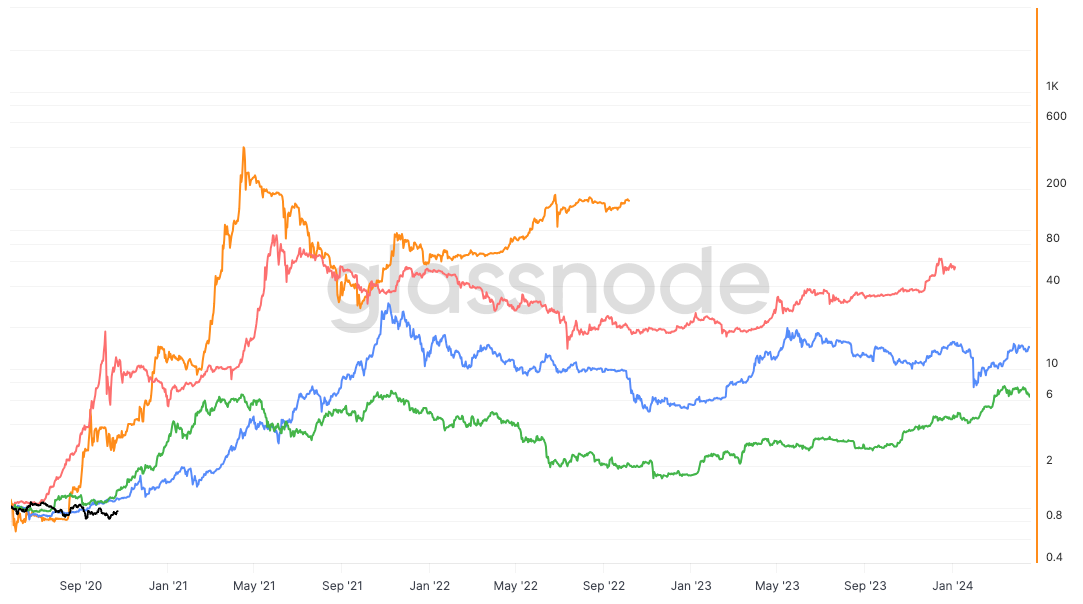

I’ve been disproportionately bullish on ETH over almost all other crypto assets since I first started properly investing in crypto in the waning hours of 2020.

However, over the last 6-9 months, I’ve grown increasingly disenchanted by Ethereum as a network and its sweeping promise of hosting the decentralized future. In short, I’ve been inching towards the realization that much of what it offers could be (somewhat easily) replaced by competitors fairly easily on a long enough time horizon.

In short: unlike Bitcoin, there’s extremely high competition/dilution/relevancy risk for ETH, including cannibalization from its own auxiliary L2 networks. I’ll be elaborating on this in much greater detail in future.

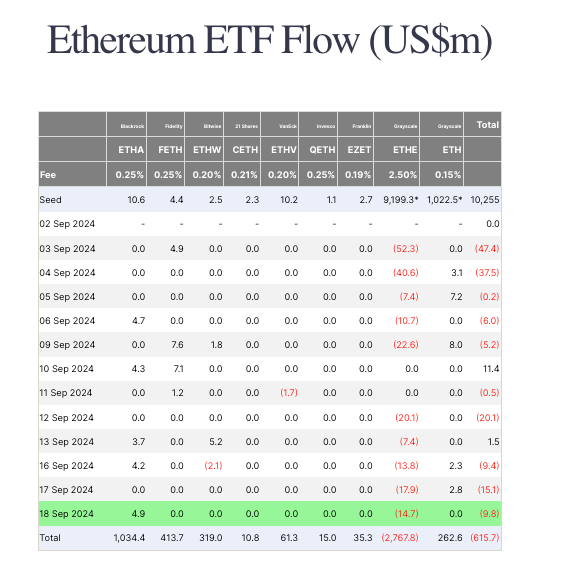

One of the most disappointing things to happen to Ethereum, at least in the last few months, has been the launch of spot Ethereum ETFs. This has been made worse by the fact that there’s been very little appetite from institutional investors to offset the brutal selling from Barry Sellbert and the rest of the crew at Grayscale.

GBTC vs ETHE: hemorrhaging compared

The conversion from a trust to a spot fund product allows Grayscale investors to dump ungodly amounts of their shares on the market (previously through GBTC for BTC and now via ETHE for ETH), smothering the price of the underlying and shaking investor confidence.

As of today, $2.7 billion worth of ETHE has been yeeted directly onto the market by the paper-handed plebs who used Grayscale for their ETH exposure.

Despite the recent sentiment, I remain tentatively bullish on ETH — less in the sense of an impending God candle and more in the sense that it will go up while other coins go up.

Forgive me, I think I’m still in the grips of the first stage of grief (denial). By the time the next newsletter is published, I’ll probably be in the midst of stage 2: anger.

Overall Market Outlook = Disgustingly Bullish

My outlook on crypto in the coming months remains disgustingly bullish. This is why:

Stablecoin supply has been steadily growing: Stablecoin volumes on Ethereum, Tron and several other major networks have been piling up, meaning there’s a lot of money waiting on the sidelines.

It’s only been 142 days since the Bitcoin halving.

Historically the post-halving slump-chop-range lasts an average of 150 days — so we’ve got another few weeks before you can justifiably start showing signs of despair.

Macro: Contrary to the prevailing opinion of doomers on social media, the US economy is actually quite strong: inflation is cooling, the labour market is relatively sturdy, and the increased likelihood of rate cuts means money is about to get cheaper again. I recommend reading Lyn Alden’s blog post on what rate cuts could mean for BTC and crypto.

FTX is Coming: Remember FTX? Yeah well, they managed to find everyone’s money and they’re giving it all back in November.

The people who are getting the money tried to ask for it to be given back to them in the form of the crypto they invested in the first place — so they could realise those sweet sweet gains over the last 2 years.

Unfortunately, the parasitic restructuring overloads really want to pay it back in cash (at the value at the time of the FTX crash, which is most assets have traded since 2020 lmao).

Either way, around $16 billion is set to be paid back to FTX users in the 60 days following the plan’s approval — which looks like it’s going to be put through on October 7.

Gaining an edge

I’ve been doing a fair bit of reading and touching up the old investment strategy during the chop, in the hopes of finding some mispriced assets and being better prepared for the next leg up.

When doing a little bit of leisurely research I came across something I’d been aware of for a long time but never really delved into: most of the best crypto investors are former (or still active) professional poker players.

There are several main reasons why many of the best crypto investors are former (or current) professional poker players:

They have an absurd risk tolerance.

They’re comfortable with huge swings in the value of their holdings.

They’re used to trading in the absence of any “fundamentals” and playing each hand as it comes.

Most importantly, good poker players follow a process-oriented system compared to an outcome-oriented one.

1) Process vs Outcome

A process-oriented investor ties their psychological well-being and sense of self-worth to how well they can execute a repeated, slightly variable process, regardless of the intended outcome.

Where the outcome-oriented investor says “I’ll sell this token when the price reaches X amount” — the process-oriented investor says “I’ll buy/sell this token — in proportional amounts — depending on which of the various conditions of my pre-mediated system have been met.”

In a market that trades without the traditional valuation metrics bestowed upon the world of equities and standard derivatives — one desperately needs to implement an adaptable yet semi-rigid system for investment.

Instead of anchoring their expectations to a lofty goal (outcome-oriented), they keep playing the best “hands” available to them — constantly looking to maximize the upside without minimizing the downside.

The Process

During the memcoin mania earlier this year, I ran a varying system that looks roughly as follows:

Always sell 20-40% of the initial position on a 3X / 4X — depending on how quickly the token runs and whether or not I think it has potential.

Cover initials quickly, and then adjust profit-taking based on how much volume the token generates and how much liquidity gets locked away.

During peak SOL mania — I applied this risk-off process due to how many tokens would shit the bed around the $3-$10M market cap threshold.

While this worked very well for scraping solid, consistent profits on smaller coins, it was atrocious at capturing any life-altering upside of memecoins that rallied hard over several weeks.

I ran this model on Boden and left well over $80,000 worth of gains on the table. But on the ~400+ other coins, it worked wonderfully. Ultimately it’s very hard to discern which memecoins are going to be viral sensations and which ones are going to be another piece of forgotten garbage on the Solana blockchain.

I would suggest making friends / rubbing shoulders with talented degenerates and getting to know the trenches of your respective ecosystem.

2) Second-level thinking

Another crucial element of gaining an edge comes down to second-level thinking, which is a very basic concept that I’ve borrowed from billionaire investor Howard Marks.

Marks outlines the importance of second-level thinking in his book The Most Important Thing — something I recommend every amateur pleb (like me) to read if they’re looking to up their game.

Second-order thinking is easy in theory but much more difficult in practice, as it places the burden of responsibility firmly on you at all times.

You actually have to have confidence in your own ideas, which requires time, effort and real thinking — not just reading other people’s opinions on the internet and regurgitating them internally or passing them off as your own to your friends on the internet.

First-level thinking is “simplistic and superficial” and just about everyone can do it. The only thing a first-level thinker needs is an opinion about the future and to act on it: “The outlook for Bitcoin looks good so the price will go up.”

A second-level thinker needs to answer many complex questions. Here’s a rough checklist I’ve been using to narrow down my own thinking and work through my theses:

The checklist:

What is the range of likely future outcomes?

What outcomes do I think will occur?

What’s the probability I’m right?

What is does the consensus think?

How does my expectation differ from this consensus?

How does the current price for the asset match with the consensus view of the future, and with mine?

Is the consensus psychology that’s incorporated in the price too bullish or bearish?

What will happen to the asset’s price if the consensus turns out to be right — and what happens if I’m right?

NGMI Capital Updates

The CIO of NGMI Capital took three main trades this week.

1) Popcat

Roughly three weeks ago during the Yen Carry Trade Unwind™ the CIO shared that he purchased some additional POPCAT at the $0.299 mark. On Sunday morning, the CIO sold this recently acquired POPCAT for a 120% gain on a position of medium size.

He still holds a lot of this particular cat token and has not reduced his overall exposure beyond selling the position taken a during the short-lived unravelling of the market.

It was a simple trade, and the CIO is aware that he could have spread capital more intelligently and dutifully across a variety of memes and amplified gains.

However, the CIO is practising not spreading himself too thin across a swathe of smaller trades, and getting good at building conviction on a single move and throwing his weight behind it.

It’s more nausea-inducing and awful in the moment but from a psychological perspective — a single sizeable trade is far easier to manage than multiple mid-sized ones.

The CIO believes it was Martin Luther King who once said “don’t diddle in the middle” or something that effect.

2) CLOUD

The CIO has been adding little clips of CLOUD to the portfolio every few days for the last month (yes, the trenches are so tragic that utility tokens have become interesting again).

Cloud is the native token of the Sanctum ecosystem — a new liquid staking platform on Solana.

Despite receiving what can only be described as a paltry fucking airdrop from farming the shit out of the protocol, the CIO believes the launch of CLOUD was about as fair as one is going to get in these conditions.

The team didn’t buy into the low-float/high FDV meta at all and launched at a fully diluted value of around $300 million and touts a current market cap of $65 million.

3) PRIME

The CIO has finally started buying some PRIME.

It’s gonna a big one when it goes.

He will elaborate much further on this in another post.

Portfolio

The CIO is currently holding personal long-term positions in the following coins. Yes more than half the current portfolio is in a single memecoin. But, to be fair, it is a very strong memecoin.

(Listed by order of approximate weight)

Popcat (POPCAT)

Solana (SOL)

Ethereum (ETH)

Bitcoin (BTC)

Dream Machine Token (DMT)

Pyth Network (PYTH)

Pendle (PENDLE)

Celestia (TIA)

Dymension (DYM)

Creso Wallet (CRE)Prime (PRIME)

Stacks (STX)

Vector Reserve (VEC)

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do.

All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.