Don't Falter, Don't Fuck It Up — NGMI Newsletter #5

Now is not the time to lose conviction, that comes later. Market overview, Ethereum ETF prediction, SEC vs. Uniswap, NGMI Capital updates and more.

The sentiment has stumbled somewhat for crypto since I last wrote this newsletter.

In the seven days between now and my last post, bulls have become what feels like an endangered species and bearish prattle about “local tops” and “it’s so over” seem to have fallen in all around us.

I find this lack of conviction equal parts disturbing and pathetic.

Although — in all fairness — this kind of bipolarity makes sense when you consider the following points:

People still legitimately believe macro has a significant correlation/impact on crypto prices.

Everyone’s perceived sense of gains has been ransacked by a memecoin-addled overdose of dopamine. This was dished out to nearly everyone who was smart (or lucky) enough to take a 1 SOL punt on practically any shitcoin launched in the last month. Now anything less than a 10% weekly gain on majors just kinda feelz bad man.

Some people simply cannot be helped and will map their emotions to whatever colour the daily BTC candle is.

Still, many seem to have forgotten that crypto isn’t just a perfect up-machine and numbers don’t get incrementally higher at all times forever.

So let’s do a quick overview of where we’re currently at:

Bitcoin’s hard bounce = good

On Wednesday, the price of Bitcoin stumbled on the news that CPI (a bunk metric for measuring inflation but it’s the best we’ve got) had increased 3.5% over the last 12 months.

Naturally, Bitcoin wicked down from a nice weekly high of just above $72k and briefly touched the low $67k range. What fills me with indubitable confidence is seeing the dip slurped promptly despite the pervasive fear around what seems like fairly entrenched inflation.

As Gammichan writes:

“Scared normies initially sell the news”

“Big money that knows its actually bullish steps in and steamrolls them.”

In short: higher.

Ethereum ETF: not happening (and that’s fine)

I’m going to place myself firmly in the mid-curve camp here and say that an Ethereum ETF simply isn’t going to happen by Van Eck’s final deadline on May 23.

Van Eck’s application will be rejected and because the SEC isn’t in the business of picking favourites — all the other applications will be too.

I’m extremely aware of the fact that BlackRock has a 575-1 record for getting ETFs approved.

I’m no legal expert (just a humble low IQ journo) but I do believe that if they reject Van Eck’s application on May 23rd the SEC will give BlackRock and other prospective fund issuers the chance to withdraw their respective ETH applications.

Don’t take it from me, take it from old mate Jan van Eck (VanEck CEO) himself.

In a purely selfish sense — I’m breathing a deep sigh of relief that ETH (almost certainly) won’t be getting an ETF in the next month.

Why?

Because it allows more time for price action to accumulate sustainably. If we got an ETH ETF in May I fear that shit would run up too fast and too furious, leading to an inevitable and rapid turbo puke

For those unfamiliar with the giga-chad Bob Loukas’ concept of a “left translated cycle” it essentially means we get a fucking monstrous run-up where prices soar very quickly but overall, we actually spend more time in the bear part of the cycle.

While the part where the number goes up sounds quite nice — it’s important to remember that massive rapid pumps typically equal bigger, more brutal dumps. In short, nothing is really bearish to me in these conditions.

I’m allowing short-term “bad” news to interrupt a wider market climate that should be seen as quite lovely.

Now we sit on hands and enjoy the ETF-led inflows into BTC, wait for the regulatory circle-jerking from the SEC to shake out, ride some upwards-leaning chop for a few months and prepare for a nice post-halving turbo send.

The SEC really sucks

Now I don’t want to get called out as a Gary Gensler simp — but for quite a long time I didn’t understand the passionate disdain that many crypto natives had for the United States SEC.

For a long while, I very much saw them as a run-of-the-mill boomer-TardFi-regulatoor, just doing what could be generously misinterpreted as a “botch job” of regulating a space that moved too quickly for them to understand.

But now, with questionable lawsuits against crypto firms like Coinbase that have tried to engage with them on regulatory matters for years, their utterly backwards guidelines for crypto custody in the U.S. (SAB 121) and their latest cheap shot at UniSwap — it’s become abundantly clear that this a wayward regulator drunk on self-righteous policymaking.

In my humble opinion, they appear to not give one solitary fuck about protecting investors and are politically obsessed with bringing down digital assets no matter the reputational cost.

I’m not going to go into the Uniswap debacle in full because I’m lazy and this is just a fun little newsletter, but this entire debacle strikes me as “arbitrary and capricious” to borrow words from the courts.

Lessons from Dark Forest

Last week I had the pleasure of discussing cryptocurrency with Dark Forest. He’s an analyst at angel investment firm Tangent Ventures, a friend and an all-around giga brain who (for some reason still unknown to me) doesn’t mind when I pester him with lots of finicky questions.

Here’s the TLDR of our discussion:

Solana is very much on the way to establishing itself as the “third network”

Why no one is bullish enough on Parallel as the ultimate AI + gaming crypto project ( $PRIME).

Dark outlines a bull case for Ethereum that is simply beyond the wildest dreams of many.

Some of the richest people in the world are still only just being orange-pilled. Bitcoin adoption shows little sign of slowing down in the near term.

People need to separate memecoins and what they mean for the reputation of the crypto industry.

Retail is definitely here but not in droves + the metrics we use to figure out when things get overheated will be vastly different.

NGMI Capital Updates

Sorry to disappoint but the CIO made zero new trades this week. He was getting relentlessly chopped up Solana shitcoins and decided to give it a rest for a while.

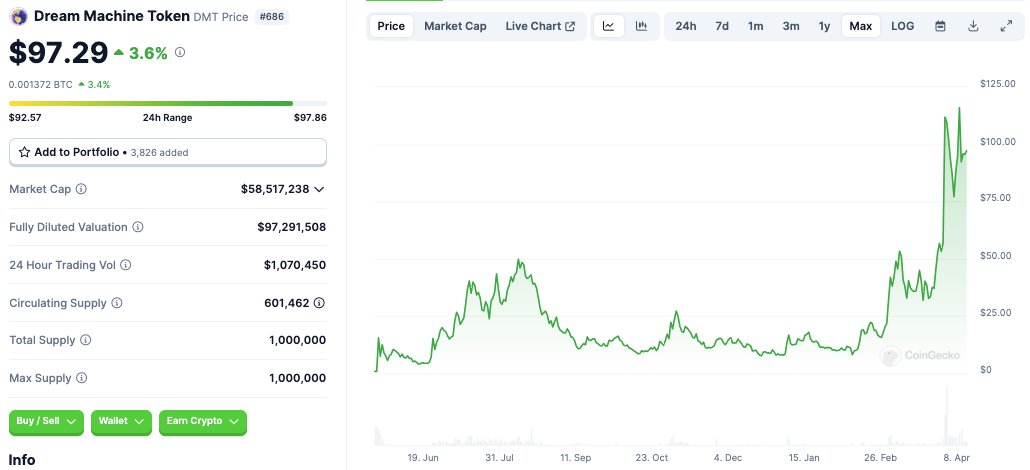

1 DMT = 1 ETH

The CIO practices what he preaches.

He remains grossly convicted on Dream Machine Token (DMT).

If you’re new here - the CIO suggests reading Blockgrazes’ piece on DMT to better wrap your head around this particular coin.

The CIO has heard things to suggest that the Sanko ecosystems Layer 3 is now completely ready for launch — the team are now just awaiting final audits and are chomping at the bit to green light this shit.

Notably, the CIO doesn’t believe the launch of an L3 will be enough to bring about serious price appreciation, as this kind of requires a deeper narrative around L3s for absurd number-go-up technology to be fully realized.

Either way, none of this short-term gobbledegook matters. DMT is a top 100 coin.

Let the re-pricing begin.

Portfolio

The CIO is currently holding personal long-term positions in the following coins. (These are listed by order of approximate weight)

Solana (SOL)

Ethereum (ETH)

Bitcoin (BTC)

Dream Machine Token (DMT)

Celestia (TIA)

Pendle (PENDLE)

Dymension (DYM)

Creso Wallet (CRE)

Pyth Network (PYTH)

Prime (PRIME)

Stacks (STX)

Vector Reserve (VEC)

The CIO also enjoys a little bit (A LOT) of on-chain gambling. Here are his current degenerate shitcoin holdings:

Popcat (POPCAT): Popcat to $1 is pre-ordained. Return to this post in a month.

ZYN (ZYN): You mean to tell me this isn’t a minimum $500 million token?

UpsideDownCat (USDC) on Solana: The CIO is so far underwater he’s scuba diving but he is committed to seeing this to 1 gorrilion dollars or zero.

Circle (CIRCLE) on Base: Fun ponzi with inbuilt burn mechanism. Study safemoon.

Welsh (WELSH) on Stacks: Generational Welsh.

Zeek Coin (MEOW) on ZkSync: Mascot coin of ZkSync eco. Still looks good (and just wait for the ZkSync drop)

Positions are roughly in order of weight. One day the CIO will get around to organizing this better. But not today.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do. All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.