Dips Are For Buying — NGMI Newsletter #2

Purchasing more Ethereum, Layer2s get ready for liftoff, altcoin pumpamentals, NGMI Capital Portfolio Updates, merch and more.

The market looks extremely different from how it did a year ago, and the same behaviors/thought processes that made money back then simply won’t work today.

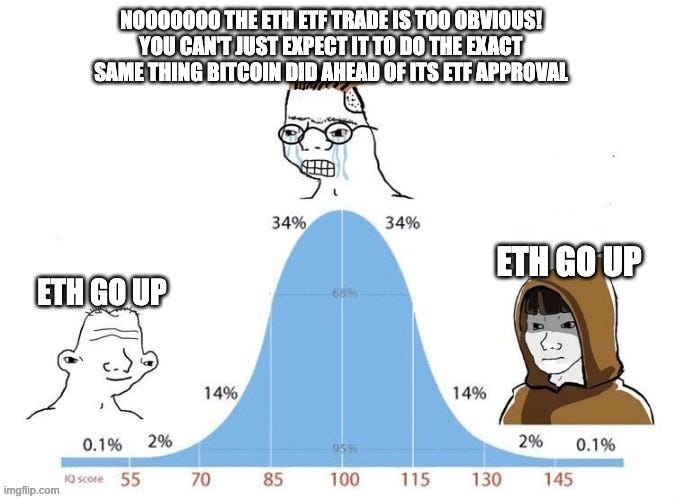

In other words — don’t overthink it.

Strap on your left-curve hat and keep bidding.

Ethereum: slowly, then all at once

I know that quite literally every human being who has ever owned cryptocurrency has flipped bullish on Ethereum right now, but that’s because sometimes the most obvious trade is the trade.

Remember how Bitcoin started turbo sending midway through last year — driven by the catalyst of an impending spot ETF approval? Then after it was approved we saw billions of dollars worth of new inflows and a surge through $50k?

Yeah. Now imagine that — but for Ethereum.

It really is that simple.

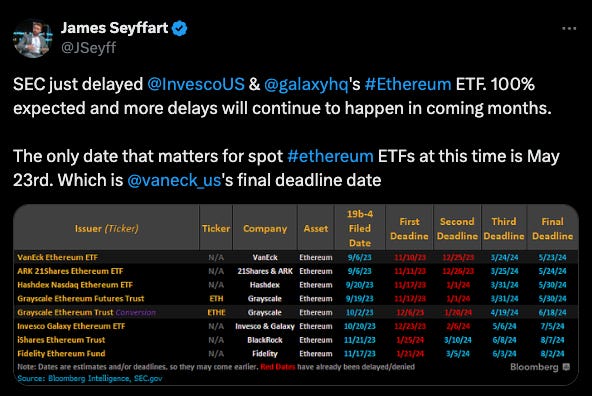

Now that the market is aware of the kind of buying an ETF can bring, it’s very clear ETH will continue a lovely upward grind leading its eventual spot ETF approval, most likely happening sometime in late May but potentially later (due to expected SEC stalling).

It’s worth noting that Ethereum has a habit of underperforming right until it gets its teleport candle and then reaffirms itself as the global, decentralized world computer upon which the future of all financial activity will occur.

The Ethereum trade only becomes more bullish when you look at the sheer scale of ETH ecosystem developments coming in the next few months; Eigenlayer and the whole re-staking narrative, Dencun upgrade and the ensuing rush for Layer2 action, a new multisig (sorry Layer2) called Blast and much more.

As of right now, there’s no final or clear-cut date for date for an Ethereum ETF, but resident Bloomberg ETF chad James Seyffart believes the “only date that matters” for now is May 23rd; VanEck’s final deadline.

Altcoin pumpamentals

I’m also very partial to the thesis that altcoins are primed for a very hefty run in the coming weeks, led by Ethereum and the wider ETH ecosystem’s grind upwards.

Now I’m no trader, nor am I anything of an analyst, but I think that the alts that perform best will be those that leverage ETH in some capacity.

The rising tide will lift all boats and while I’m sure the old-guard altcoins like Avalanche, Polkadot and (god forbid) Cardano will see upside moves, the bulk of the gains will be concentrated in ETH beta.

Caveat: while the ETH beta plays will be strong, only a select few will truly outperform Ethereum in a meaningful way. So, unless you feel confident picking winners with very strong narratives, (which I think will look, smell, and feel like re-staking protocols) it’s probably best to stay allocated in spot ETH and ride the wave without burning out chasing shiny things.

Starknet. Forget now, buy later.

Thought airdrops couldn’t get worse much than Jupiter Exchange — you know, the decentralized exchange aggregator that launched at an FDV of ~$6 billion?

You’d be wrong.

I won’t spend long rambling on this one, but Starknet cooked their airdrop pretty hard. Now, there’s nothing wrong with giving out your tokens to those who actually contribute to your network (legitimate developers and builders) but the antics than ensued following Starknet’s botched airdrop were nothing short of hilarious.

This was one of those cases where it was probably best for most of Starknet’s management to let the PR people handle the responses instead of spewing diatribes about “entitled” users — who are, coincidentally, participants of the market that will buy their coin.

Now this isn’t a statement that should be understood as though I’m saying go out and short the bloody token.

The hated coin thesis is strong with Starknet, and there will be innumerable rips and dips while this consolidates (lower) for the next few weeks.

Put a calendar reminder in for early March. Coins that launch at hefty valuations, have shit tokenomics and are hissed at by everyone with a Twitter account tend to come up hard off the bottom once everyone’s forgotten how much they hated it [study Aptos].

While it took months for Aptos to recover, that was in the depths of a bear market in 2022. Now that we’re in uponly mode, I think it’ll only take a few weeks for Starknet to really kick off.

While the team are unlocking another 13% of the supply in two months, it helps to remember that in a bull market, unlocks are often bullish.

NGMI Capital Updates

There are very few new NGMI Capital updates this week, as the CIO did very little in the way of active investing, apart from adding more DMT to the portfolio.

The CIO is concerned that he’s a little late to the PRIME train but will be making a (relatively) hefty investment in Prime sometime in the coming days/weeks.

DMT - Still absurdly bullish

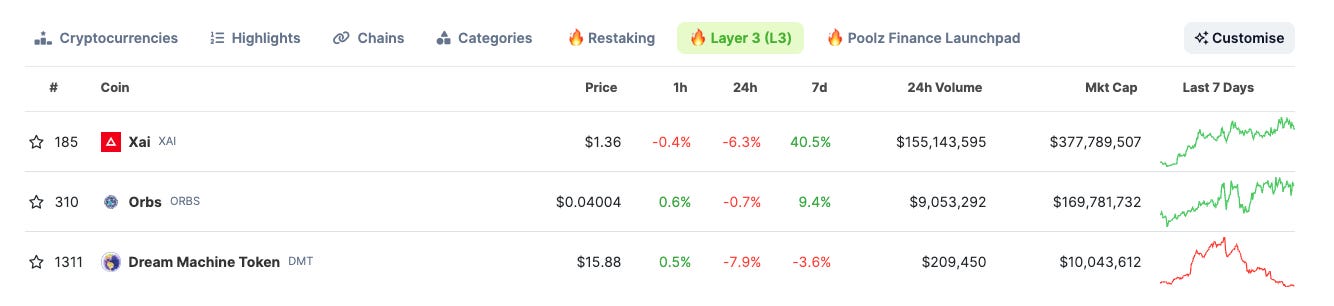

If you can look at the image below and still think DMT (the native token of the Sanko ecosystem) isn’t the most slept-on token in the entire crypto market then you are quite simply are beyond help.

There are tens, nay hundreds, of convoluted Ponzi tokens out there — where no one can explain what they do — with valuations exceeding well over $100 million+ . With DMT, we’re talking about the native token of a crypto-native gaming and streaming platform (that justy received an Arbitrum foundation grant) with a pipeline of hefty announcements coming over the next few months.

The most important of these is the Sanko Layer3 which goes live in March and features DMT as its native token. Along with the new Layer3 comes a new marketplace, which features burn mechanism for DMT. In short: bullish.

See the last edition of the NGMI Newsletter for a more in-depth case. You can also, visit the Blockgraze newsletter for more solid information concerning DMT.

Prime: AI + Gaming Narrative (still slept on)

Without going into an absurd amount of detail, PRIME is the native token of the Echelon prime gaming ecosystem, and it’s shaping up to be one of the bigger crypto games to appear of the next months.

The CIO, like many others, has been disgustingly bearish on crypto gaming, because let’s be honest: almost every single blockchain game released thus far has been a very convoluted Ponzi mechanism that farms value from new entrants and re-distributes that wealth to early/large holders.

Even when games haven’t been outright value-extraction machines, they’re typically just really shit games, and people get fed up doing the same 5 things over and over again. Paying people small amounts of money to play your game won’t do shit for retention if your game sucks, a lesson very few crypto gaming “studios” still don’t seem to have learned.

With all of that being said, Echelon Prime is probably one of a select few upcoming gaming projects that looks to buck that trend. At the moment, the only game in the prime ecosystem is a trading card game called Parallel, which is actually quite fun as far as trading card games go.

If you’re looking to gain more insight into what Prime could look like in the next couple of months, fast forward to the 20-minute mark of the following podcast to hear Dark Forest, a gigabrain analyst at Tangent explain what’s going on.

Portfolio

The CIO is currently holding personal long-term positions in:

Bitcoin (BTC)

Ethereum (ETH)

Celestia (TIA)

Dymension (DYM)

Solana (SOL)

Pyth Network (PYTH)

Stacks (STX)

Creso Wallet (CRE)

Pendle (PENDLE)

Vector Reserve (VEC)

The CIO also enjoys a little bit (A LOT) of on-chain gambling. Here are his current degenerate shitcoin holdings:

UpsideDownCat (USDC) on Solana: The CIO is so far underwater he’s scuba diving but he is committed to seeing this to $1 gorrilion dollars or zero.

Circle (CIRCLE) on Base: Fun ponzi with inbuilt burn mechanism. Study safemoon.

Welsh (WELSH) on Stacks: Generational Welsh.

Zeek Coin (MEOW) on ZkSync: Mascot coin of ZkSync eco. Looks very good.

DogWifoutHat (WIFOUT) on Solana: Don’t ever ask to see the CIO’s buy orders on this. He hopes he will be vindicated one day. This seems ever more unlikely with each passing day.

Positions are not in order of weight. One day the CIO will get around to organizing this better. But not today.

Merchandise

The CIO also owns and operates a crypto merch store, aptly named the NGMI Store. There are always fun new things being added to it — like the shirt below — so feel to check it out.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do. All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.