Bitcoin + BlackRock = Big Bull Market — NGMI Newsletter #3

Unholy ETF inflows, Solana memes, left-curve alt season is simple, NGMI Capital Updates and more.

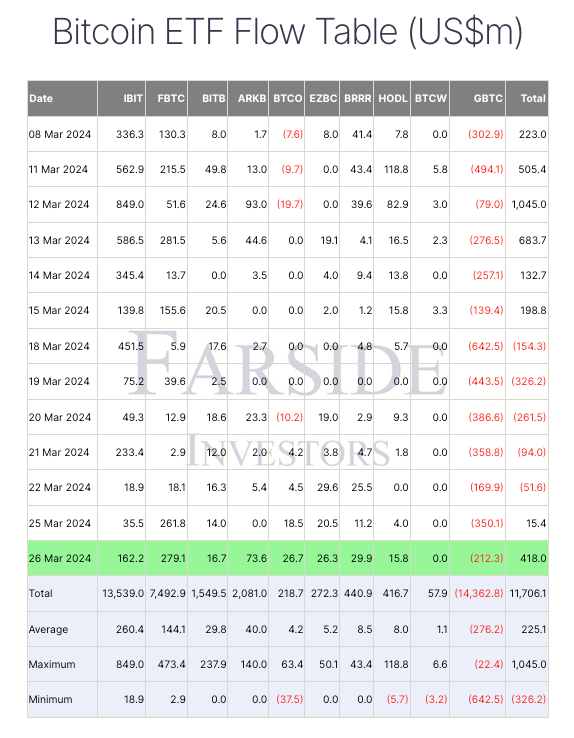

Last week everyone’s favourite institution Grayscale dumped nearly $900 million worth of Bitcoin on the market, with Genesis and DCG-related bankruptcy selling seeing its outflows reach a fever pitch.

The price of Bitcoin (BTC) held up incredibly well considering — only really stumbling around 10% from a local weekly high of $68,500 to a low of $61,700 during peak dumpage.

Now, Bitcoin is back at around the $70,000 mark — showing that it’s quite capable of marching directly to $90,000 around the time of the halving.

During Grayscale dumping, several market commentators took it upon themselves to flip bearish and began espousing insane, hot-garbage takes about being “cautious” and hinting that the bull run might be “over.”

If you took a brief 10% drawdown as a sign of the bull run being “over” — kindly remove yourself from this market and go find a suitably damp hollow to crawl into until this market has cooled down.

We are only just entering into price discovery for Bitcoin, and soon, several major and hundreds of alts will follow – if they’re not already there.

This isn’t to say that the price of Bitcoin can’t still dip below $60,000 if Barry Sellbert and all of the bankruptcy bois that are still grossly overweight GBTC shares feel like dumping for some more liquid gains.

BUT — what it does mean is that the hammer-spring for the fully automatic machine gun of Bitcoin’s price action following the halving is wound tighter and tighter: a positive feedback loop of the virtuous gains to be had starting in June.

ETF inflows are not ‘catalysts’

While many look to ETF inflows as these constant taker orders (sole drivers of price action) — it’s more useful to think of them as backstops.

Sure, the market looks to inflows vs. outflows to gauge institutional sentiment but they’re not buying because of big inflows after the fact.

TLDR: solid inflows bring up the ‘floor’ of price action a little higher each time. It’s not a huge caveat, but it shifted my thinking around actually looking at real catalysts.

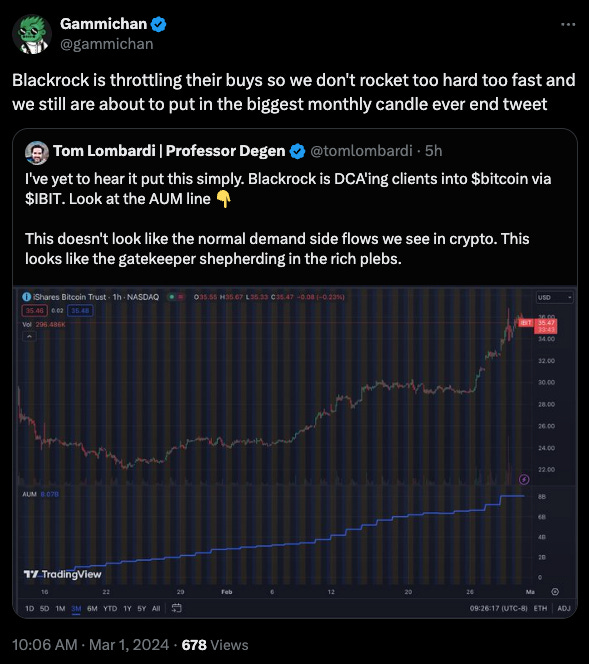

At the start of this month, Gammichan wrote that we’re about to put in the biggest monthly candle ever. Looks like he’s right.

Memecoin / Altcoin Season: It’s Simple

The cornerstone of investment is delayed gratification.

While crypto is very well-known as the brutal and glorious free market where you stand to make thousands, nay gorillions of dollars effectively overnight, it still requires a lot of relative patience.

Unfortunately, the relative speed of crypto can make it feel as though you’re somehow missing every life-changing opportunity while everyone else is somehow printing 9 figures on their respective memecoin of choice.

Delete this thinking from your brain. There are no one else’s positions but yours.

Be patient, but not too patient

Memecoins are brutal, and there’s not much in the way of genuinely good advice for picking them.

Most people will either lose money or round trip by buying things early and “nEvEr SeLliNg.” Sure, sometimes never selling works, but you usually end up roundtripping serious gains.

Always take small profits on a run-up of the small-cap coins and let the rest ride.

If you’re not confident in your ability to pick micro-cap memes off DexScreener, just add to proven meme winners that already have plenty of traction across social media and show signs of picking up on news events in the future.

Key examples are Boden, Tremp, Zyn, Popcat, dogwifhat etc.

Again this is not to say that memecoins are a “good” investment or that it’s a wise decision to put in more than you can afford to lose — BUT: making gains in memecoins is about trading attention.

Either front-run attention on things you think are funny with small size, or add to things that already have attention with larger size.

Size Matters: By reducing the initial amount you throw into new, small memecoins you’ll sleep better and you’ll be less likely to sell at a loss when things inevitably go underwater.

Altcoins

The altcoin “thesis” is as follows:

assuming there is 1) an alt season, 2) no macro nuke that sinks the market (more unlikely with each day) and 3) the current largest memecoins will remain the largest memecoins — then it is relatively safe to assume that tokens such as Avalanche (AVAX), Cardano (ADA) and others will provide investors with a good deal of opportunity.

The wonderful thing about the current market is we’ve already had the foundations laid for a proper memecoin rally. All of the respective ‘aLt lAyEr oNe’ blockchain networks have their winning memecoin of choice set already, meaning that all you have to do is find the premier memecoin on that chain and catch a bid.

If you want to go further down the meme risk curve, you can try and find secondary tokens you think will be the 2nd and 3rd place holders, but you start to run the risk of deleting your hard-earned cryptocurrency rather quickly.

And if I lost even $100 betting on Avalanche shitcoins I would feel pretty bad about it. So I’ve thrown quite small-sized bids (the more you size into the memes — the worse you sleep at night) at each chain’s fastest horse. I will proceed to forget about it for the next few months.

This thesis is quite obviously exposed to several huge risks, and could implode on itself like the Hindenberg if/when the music stops. Hence, you need to also have an exit plan (but that’s for a much later newsletter).

If you don’t feel like buying memecoins and feel like you’re stuck when it comes to finding more “stable” tokens to purchase — go look at the coins that are available on mainstream investment platforms.

When everyday retail buyers return to crypto, they’ll pick up the stuff that’s available to them.

NGMI Capital Updates

Firstly, the CIO of NGMI Capital would like to apologise for the delay in issuing this (what should be a weekly) newsletter.

He was consumed by the Solana memecoin season — and despite it shifting his attention from pursuing meaningful work — he is pleased to admit that the period of distraction was relatively profitable.

DMT: The Market Remains Mispriced

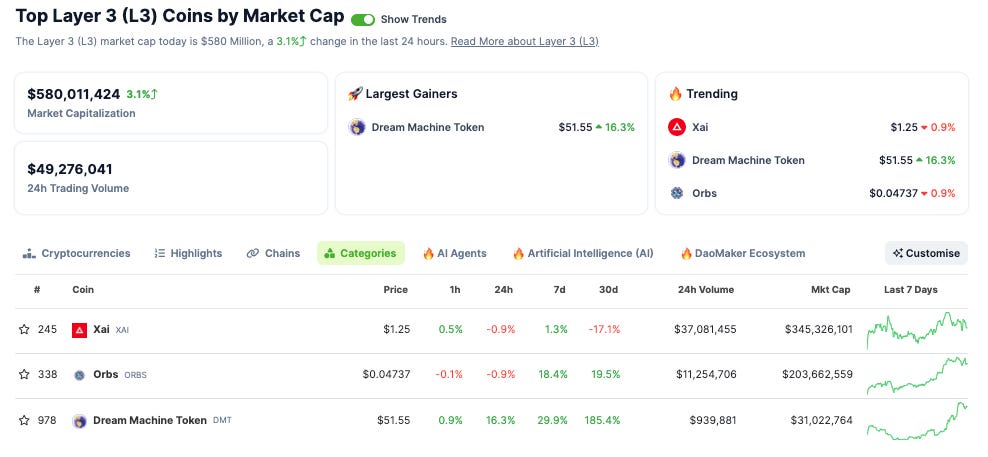

DMT is the native token of the SankoGameCorp ecosystem.

In short: Sanko is Twitch for degens. Sanko is also releasing its own Layer3 chain (a blockchain built on top of a Layer2) where DMT is the gas token.

On the main Sanko gaming platform, users can play retro arcade games, there’s a fully functional poker app with more interesting game developments (think Runescape) coming hopefully by the end of this year.

All of this is available at a $30 million market cap while daily platform revenues consistently break all-time highs.

The CIO will keep sharing the image below until the end of time. One of these is not like the others…

Holders of DMT need to prepare themselves for the impending god candle. Sidelinoors should understand that wherever the price is right now — is literally the generational pico bottom.

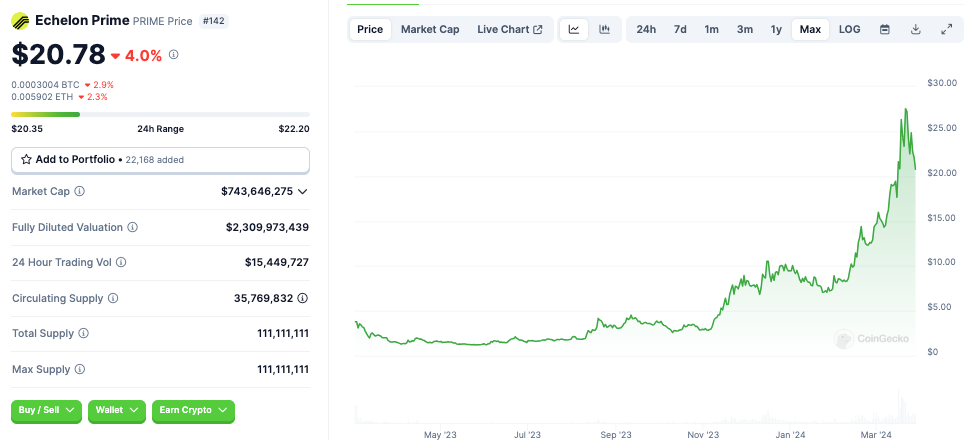

PRIME: Better than Google

The CIO will keep this short and sweet.

Echelon Prime is a blockchain game that isn’t like the others. It’s currently a trading card game but they’re looking to release an open-world RPG called Colony in the coming months which is rumoured to feature AI tech that’s more advanced than what Google is working on.

TLDR: Prime is this cycle’s Axie Infinity. Except it’s actually good.

The chart also looks like this.

Portfolio

The CIO is currently holding personal long-term positions in the following coins. (These are listed by order of approximate weight)

Solana (SOL)

Bitcoin (BTC)

Ethereum (ETH)

Celestia (TIA)

Dream Machine Token (DMT)

Pendle (PENDLE)

Creso Wallet (CRE)

Dymension (DYM)

Pyth Network (PYTH)

Prime (PRIME)

Stacks (STX)

Vector Reserve (VEC)

The CIO also enjoys a little bit (A LOT) of on-chain gambling. Here are his current degenerate shitcoin holdings:

Popcat (POPCAT): Popcat to $1 is pre-ordained. Return to this post in a month.

ZYN (ZYN): You mean to tell me this isn’t a minimum $500 million token?

UpsideDownCat (USDC) on Solana: The CIO is so far underwater he’s scuba diving but he is committed to seeing this to $1 gorrilion dollars or zero.

Circle (CIRCLE) on Base: Fun ponzi with inbuilt burn mechanism. Study safemoon.

Welsh (WELSH) on Stacks: Generational Welsh.

Zeek Coin (MEOW) on ZkSync: Mascot coin of ZkSync eco. Looks very good.

Positions are roughly in order of weight. One day the CIO will get around to organizing this better. But not today.

Banger piece