A Very Good Time to Be Disgustingly Bullish — NGMI Newsletter #1

Absurd volume on Bitcoin ETFs, why pushing shit up with hill with Bitcoin L2s is EV+, Ethereum pump soon, smoking DMT, NGMI Capital updates and more.

There are a good many things to be bullish about in crypto right now. The most obvious of which is the fundamentally absurd volume of inflows into spot Bitcoin ETFs.

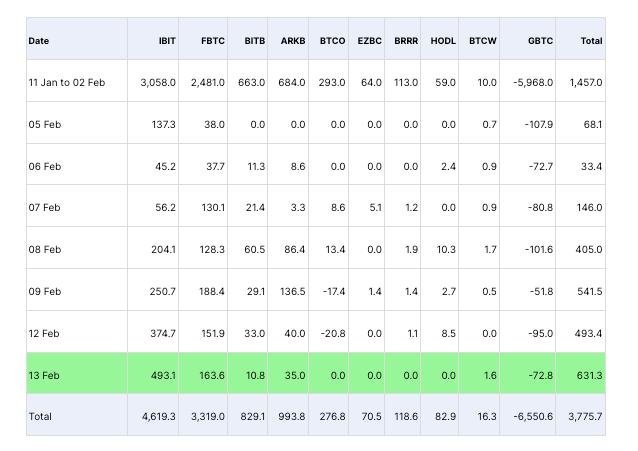

Yesterday alone BlackRock’s IBIT generated fucking $493 million worth of new inflows, which for the innumerate among us is just short of half a billion dollars. That’s half a billion dollars worth of inflows into a single fund, in a single day.

In total, Bitcoin ETFs saw $631 million in inflows on February 12. This is insane. It’s almost insulting how little this statistic is being bandied about across the social media platform formerly known as Twitter.

And don’t just take it from me. Take it from Foobar, who’s correctly predicted that if flows keep up this kind of momentum, it’s not unreasonable to expect new all-time highs for Bitcoin within the next 45 days.

Anyone giving off even the slightest hint of bearish sentiment right now should be considered a deeply unserious person.

The outlook for Bitcoin only grows more bullish when one considers that:

We’re still two entire months out from the halving

Sam Bankman-Fried is in prison and isn’t selling billions worth of fake funny money.

Rates are coming down.

Slowing GBTC outflows.

Retail still hasn’t arrived in a meaningful way (the current members of CT are sophisticated retail).

Rekt Capital has a fantastic X thread on BTC’s price action around the halving for those interested.

With all of this said, it’s still a PVP market. There’s no denying it.

BUT — it is gradually becoming more PVE.

Significant volumes of that incredibly sweet and delicious institutional capital are gushing into the books which means fewer terrible pullbacks and less significant rotations between coins.

Soon the rising tide will lift all boats. As always, however, some boats will be lifted more than others.

The first boats to be lifted will be those building on Bitcoin.

Bitcoin Layer2s: It’s Time

The overall bullishness on Bitcoin should — for all intents and purposes — mean that projects building on Bitcoin catch a significant bid as well.

Do you really think all of these fund managers and TradFi nerds now only just looking into Bitcoin for the first time are going to stop at the “heavy orange rock good” part of Bitcoin’s value thesis?

Absolutely fucking not.

They’re going to look for utility on Bitcoin and milk it for every last drop of potential value. And that value going to be found in Layer2s (DeFi on BTC) and other more fun things like Ordinals.

Now, you might ask: “But Tom, why on God’s green earth would you build on Bitcoin when cheaper, easier, faster alternatives are right there?” (Ethereum, Solana, ETH Layer2s etc.) and you’d be partially correct.

The semi-contratian thesis is as follows: essentially, the more difficult it is to build on a given blockchain the more dedicated the developers and the more Lindy one can expect the resulting protocols to be over time.

While I’m aware that Lightning exists, I believe it’s more important to consider Stacks beforehand (bc Lightning kinda sucks). We can go into why this is the case later, but Stacks seems to be one of the more promising BTC ecosystems out there.

While transactions on Stacks still take approximately 45 minutes to execute (lol), investors can look to the Nakamato upgrade — slated to arrive around the time of the halving — which will see transaction times significantly reduced. I don’t pretend to be good at predictions but I do expect bountiful growth on Stacks around this time.

The native token of the biggest decentralized exchange on Stacks: ALEX as well as the chain’s flagship memecoin WELSH are probably worth a bid here.

Caveat: BRC-20 farming and other assorted (formerly very profitable) BRC-20-related ponzinomic protocols are sinking ships. Many of these projects caught a major ride along with ORDI but didn’t really offer anything novel apart from being overhyped rewards tokens (cough* Bitstable Finance [BSSB] cough*). I have divested accordingly.

Ethereum ETF: How Bullish Should One Be?

The CIO spoke to Marty (@thinkingvols) recently on the fourth episode of the NGMI Podcast — which you can listen to here — about how bullish one should be on Ethereum when considering that a spot ETF is almost certainly coming by May.

Marty was kind enough to share his take on the upcoming Ethereum ETF, which will be summarised quickly below:

In Marty’s view, we’re going to see almost exactly what we saw heading into the Bitcoin ETF. Investors will get “horny” for ETH in much the same way they did for BTC.

Now that institutional investors know that a Bitcoin ETF can attract over half a billion in inflows in a single day, it would be pretty surprising if excitement for spot Ethereum ETF didn’t translate into some very spicy price action for ETH.

With that said, ETH does this beautiful thing where it somehow always manages to underperform expectations.

I do not expect this trend to continue for much longer. The Ethereum move will be powerful and will leave bears shuddering in a state of disbelief.

Seriously. If you can look at a chart like the one below and still maintain a bearish position I would suggest signing off and not bothering with investing.

Caveat: It’s worth noting that I’ve desperately mid-curved the ETH play by over-allocating to ETH during the bear market and currently hold around 50% of my cold-storage deep-coma portfolio in stETH.

My bullishness on ETH is partially fueled by reason + cold hard data, but also significantly by hopium and mid-curve desperation.

NGMI Capital Updates

DMT: The Market is Wrong

The CIO of NGMI Capital is not a particularly smart nor a very wealthy man. However, he tries his best to identify opportunities and then execute on them in the right way.

Yes, he gets chopped up trading stupid shit from time to time and frequently buys the pico top on coins, but he strives every day to be more correct, at the right time with the right amount of size.

This leads him to his favourite (and most accursed) holding of the current cycle: Dream Machine Token (DMT) the native token of the Sanko Game Corp ecosystem.

Sanko is a gaming platform that combines SocialFi (they have a Twitch-style streaming platform called Sanko.tv) and a game studio with five games currently live on their website. There have also been many allusions to the team launching RuneScape on the platform…

Sanko is releasing its Arbitrum-based Layer 3 network called SankoChain in March.

Another fun fact is that DMT can be held in the wallets of Sanko.tv users to harvest points that go toward receiving an upcoming Arbitrum airdrop. The CIO regularly streams on Sanko.tv with the based chads at Brotato Capital.

The Brotato Capital wallet received an ARB airdrop worth roughly 0.2 ETH for streaming once a week for a few months.

There’s a lot to go into with the DMT thesis, but Blockgraze has a really good blog post about it, that the CIO recommends you to check out. While some of the newer developments are missing, Blockgraze goes through pretty much everything you need to know.

Aside from this very long-winded rant on DMT, the CIO is holding personal long-term positions in:

Celestia (TIA)

Dymension (DYM)

Solana (SOL)

Pyth Network (PYTH)

Stacks (STX)

Creso Wallet (CRE)

Pendle (PENDLE)

Vector Reserve (VEC)

Positions are not in order of weight. One day the CIO will get around to organizing this better. But not today.

NGMI Capital (It’s Real Guys)

NGMI Capital will soon no longer be a figment of the CIO’s imagination as he will actually be launching NGMI Capital for real in the first week of March.

This will be a public portfolio designed to test out a variety of investment strategies at a very small scale.

Due to the CIO lacking much in the way of material funds, initial investments will be limited to around $500 per month. He will buy between one and four coins every calendar month and add them to the portfolio in that manner.

The CIO is still figuring out public portfolio trackers and such but is excited to get things up and running and have a transparent fund for y’all to laugh at as time goes on.

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do. All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.

Great insight Tom