A Beautiful Recovery — Newsletter #8

Studying the bounce & the alts that outperformed, it's time to be bullish ETH (for real this time), the virtue of degenerate gambling, NGMI Capital updates and more.

Last weekend the market shit the bed and I watched the entirety of my absurdly-meme-heavy portfolio drawdown as far as 80% within the span of 72 hours.

This was the first time in the last 18 months that I was faced with the terrifying reality that the vast majority of my portfolio was comprised of speculation-driven vaporware that has no underlying value whatsoever.

This isn’t to say that all of my investments are actually worthless (not yet anyway) — it simply served as an extremely good reminder to be very aware of the kinds of conditions that I’m playing around in during the extremely strange meta of the current cycle.

Apart from being an exercise in managing fear and navigating when best to pull the trigger on some more mid-nuke memecoin bids (which felt disgusting at the time) — it was also a powerful lesson in learning to manage my own risk instead of having the market manage it for me.

“The decision to buy is always yours. The decision to sell isn't.” — Nassim Taleb

Post-nuke bliss

The TLDR of last week’s slaughterhouse was that equities and crypto tanked following a brief unwinding of the “Yen Carry Trade” and a collective freak-out over a potential recession (lmao).

I could be terribly wrong but I hold the position that the US economy has been, still is, and will continue to power along for a good amount of time, and any legitimate fears of a recession are grossly misplaced and borderline unjustifiable.

Still, the sell-off led many to laser-focus on the minutia of really stupid shit like job prints and MSI PPI data which helped soothe macro fears but, as expected, the market quickly resumed business as usual.

Crypto assets were fucked just that little bit harder than equities because:

A) the majority of digital assets are viewed by investors who lack conviction as nothing more than speculative vaporware and:

B) Everyone’s favourite trading desk Jump Trading also decided to offload hundreds of millions of dollars in positions over the weekend and kept slamming sell bids through the Monday nuke. They’re actually still going right now but their size is smaller and it’s having less of a terrifying impact on le market.

The Majors That Matter look great

The only thing that matters to me is how the three major assets that truly matter performed in the aftermath and whether or not this was indicative of a wider, systemic unwinding of risk assets (spoiler alert: it wasn’t).

I may be proven wrong on a longer time frame, but everything appeared to bounce pretty nicely off the lows and then continued on the usual (healthy) down-range we’ve been locked in since BTC hit new ATH in March.

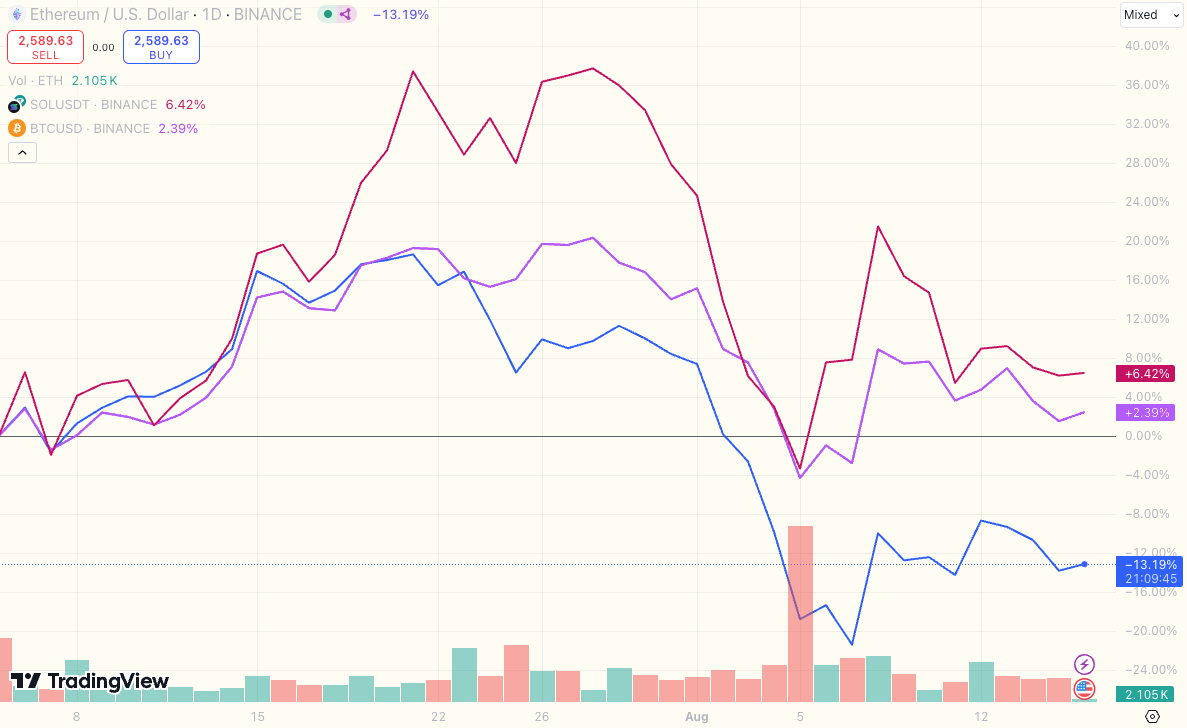

I want to look specifically at the slight differences between the recoveries of BTC, ETH and SOL following Monday’s sell-off.

Solana bounced harder but sold off more quickly, Bitcoin held steady in the middle while ETH recovered less quickly but accumulated stronger relative to other majors and far better than its own previous dips.

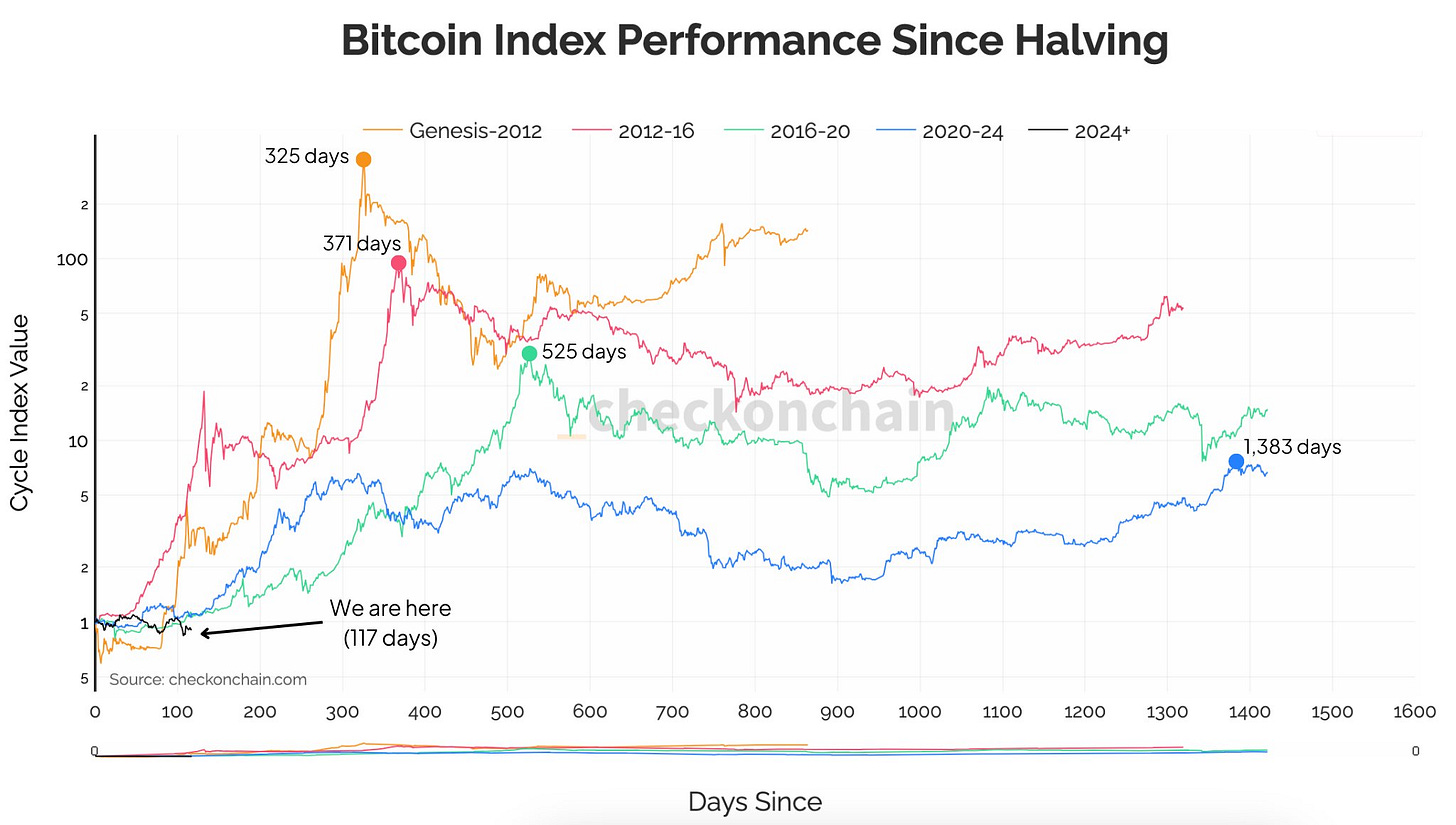

This is a blatant confession of the underlying mid-curvery of my thesis, but I’m a bulliever in the four-year cycle model.

As a result, I’m not allowing myself to become truly concerned by this godforsaken down-range unless BTC is still chopping away at $60k in January of next year.

If we’re still at these levels in 4 months — or (god forbid) even lower — only then will I start questioning my sanity.

ETH bulls assemble (it’s different this time…)

It’s not controversial to say that ETH has been, by far, the most accursed major asset of this cycle.

Over the last 18 months, ETH has consistently moved up less and down more on practically all of the major market swings. Meanwhile, Bitcoin, Solana and many other smaller alts (overwhelmingly memes) have all been melting upwards at a sickening pace since late last year.

However, after sinking to $2,100 on Monday last week, I believe this is the moment that marks the turnaround (and the generational pico-bottom) for ETH. To me, it still looks oversold, and in past cycles, ETH has displayed a tendency to underperform before zooting to new ATHs.

In the last edition of this newsletter, I spoke about why I sided with Eric Balchunas in thinking that the ETH ETFs would be “small potatoes” compared to BTC ETFs, and I still believe they won’t live up to perma-ETH-bull expectations.

This does not mean that ETH can’t experience significant upside in the next few months, I just hold the position that it will be a slower, more gradual melt upwards.

I’m still quite wary that the *checks notes* 72 layer-2 networks currently built on Ethereum will continue to weigh down the price action of our lovely underlying ETH — but my inherent bag bias is helping me to look past this for now.

With all that being said, if ETH can’t show solid signs of outperformance by December - I will officially denounce it as a smelly boomer chain and convert the entirety of my stack into something that’s built on a more solid foundation of number-go-up-technology™.

Taiki Maeda: still fully deployed…

Myself and the rest of the crew at Brotato Capital spoke to DeFi wizard and Humble Farmer Taiki Maeda last week about airdrop farming, DeFi, and the current market conditions.

In the brief time we had him on the show, he shared a bunch of his insights into how things have unfolded this cycle and what he thinks things will look like in the coming months.

Key points:

Taiki is still fully deployed in markets (for better or for worse)

He believes better days are coming, particularly for the ETH ecosystem.

Why you should always be selling your airdrops.

NGMI Capital Updates

The virtue of degenerate gambling

The CIO of NGMI Capital has transformed into more of a degenerate gambler than a chief investment officer in recent months, particularly following the takeoff of Solana memes in November last year.

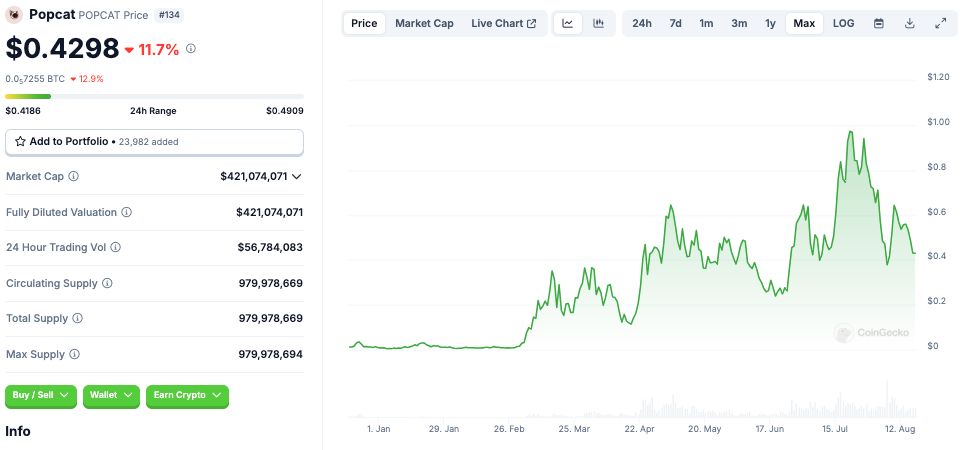

POPCAT

By far the best trade of the last month was buying more POPCAT during the nuke, picking up a reasonable order at $0.299.

The popping cat tends to show the strongest performance on BTC rips and (apart from the nausea-inducing nuke of last Monday) it’s been an incredibly strong coin to hold during drawdowns.

The CIO believes that POPCAT is one of the strongest memecoin holds of this current cycle and has no plans to sell any of his holdings until a single popping cat token is worth well above $1.

This fundamentally betrays his usual process-oriented system of investment but memecoins are the one area of the market where actually not selling until you’ve hit a stupid valuation actually works out best in the long run.

Alternatively, this could also lead to his utter financial ruin.

But hey, you know what they say about cake and eating it too.

The case for HODLing big memes

Positioning in and out of memes — especially when you have reasonable size — can prove quite difficult, largely owing to the fact that memecoins are legitimately worthless and re-buying with large sums of capital at the lows feels incredibly stupid.

When it comes to well-established memes that have a very strong community, big CEX listings on the horizon and a very normie-friendly ticker, the CIO believes that it’s easier to put it all on a ledger not look at the chart too much and only sell when it’s worth gorillions or nothing.

Disclaimer: The CIO can hold this thesis because he was early to some of the more well-established memecoins of this cycle. If he’d bid these tokens later on in their respective life cycles, he would be taking a very different approach.

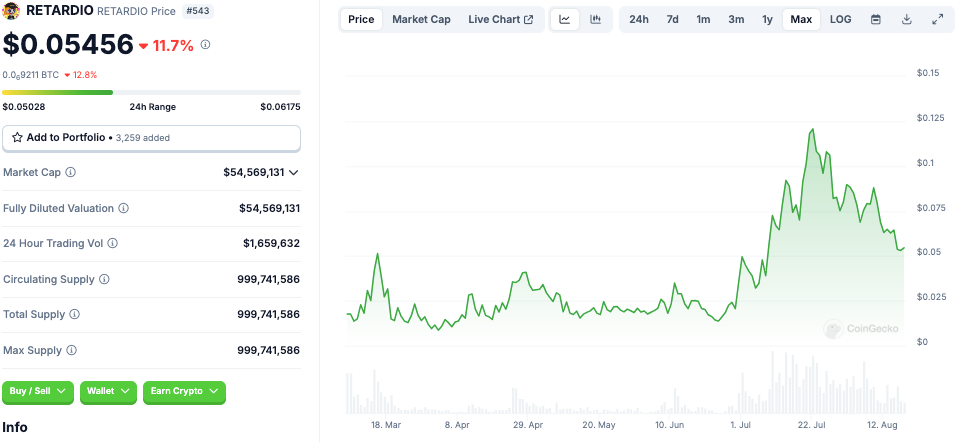

RETARDIO

The CIO trimmed the entirety of his RETARDIO position into USDC roughly 36 hours following the bounce off last Monday’s lows (which was surprisingly a really good move because it was primarily motivated by a sense of complete self-flagellation for not having de-risked sooner).

He now holds a single Retardio Cousin NFT as his sole Retardio exposure simply because they’re hilarious. With this in mind, he will probably end up using his hard-fought USDC to buy more RETARDIO sometime in the next few days because he desperately needs to feel something again.

In all seriousness, the RETARDIO cult is among the strongest and most deranged on CT and even though it’s probably not getting a major CEX listing — it’s literally called RETARDIO — it has proven itself an incredibly strong on-chain PVP coin for those willing to embrace their inner risk-freak.

Utility Coins - may the Lord help us all

Many of the more left-field “deep value” utility plays and well-researched theses the CIO held: Creso Wallet (CRE), Vector Reserve (now KERN) and several others — have been utterly murdered by the market’s complete indifference to utility-based projects in the crypto ecosystem.

At the current time, the CIO does not wish to expand on why all of his utility theses have not worked out because it’s simply too sad and mid-curve to espouse at length here.

He will do this at a later time after his financial wounds have healed.

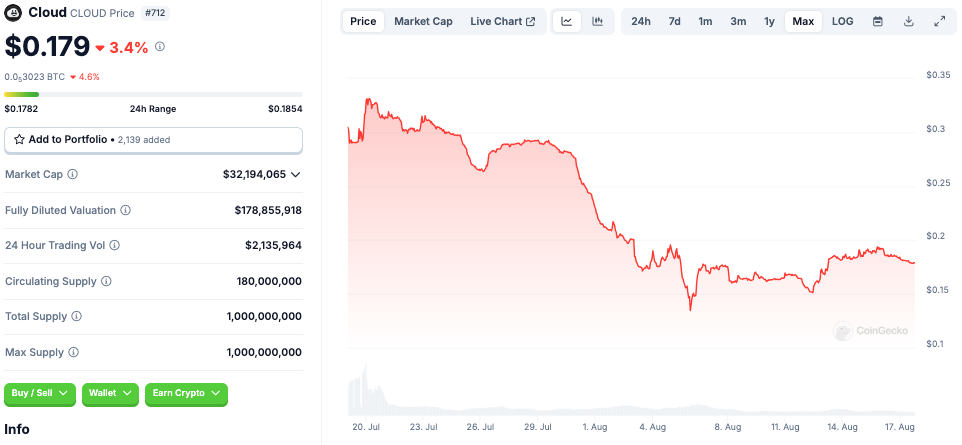

Sanctum

In the last edition of this newsletter, the CIO spoke briefly about his excitement for the Solana-based liquid staking ecosystem Sanctum and the upcoming airdrop of its governance token CLOUD.

To keep it very short, this airdrop came in brutally below expectations, with NGMI Capital netting a staggering $450 worth of CLOUD from a ~$30,000 farming position.

Despite feeling scorned by the airdrop, the CIO remains bullish on the CLOUD token.

In a cycle that’s been hamstrung by several low-float, high-FDV launches of VC filth like Worldcoin and many other coins — see Cobie post for more — CLOUD was a refreshing reminder that not everyone is desperately trying to extract value by all means necessary.

CLOUD launched at a respectable $300M FDV and is currently trading at a very humble $32M market cap.

The CIO is aware that he’s probably mid-curving once again, but he believes it would be extremely foolish to be bullish on the Solana ecosystem and not think that one of the best liquid staking/application platforms built on the network won’t substantially appreciate in value sometime in the next ~12 months.

If you’re interested in getting a better grasp on Sanctum, the CIO recommends looking at Greythorne Senior Associate Jae Sik’s breakdowns on CLOUD and the Sanctum eco.

Outside of meme degeneracy and Sanctum, the CIO also remains feverishly convicted on the Sanko ecosystem (Dream Machine Token), a new UX layer called Infinex (brought to you by the chads from Synthetix) and a few other things he’s yet to disclose publicly.

To better solidify his own thinking and provide value to readers, the CIO will be releasing breakdowns on these projects in the coming weeks.

Portfolio

The CIO is currently holding personal long-term positions in the following coins. (These are listed by order of approximate weight)

Solana (SOL)

Popcat (POPCAT)

Ethereum (ETH)

Bitcoin (BTC)

Dream Machine Token (DMT)

Pyth Network (PYTH)

Pendle (PENDLE)

Celestia (TIA)

Dymension (DYM)

Creso Wallet (CRE)Prime (PRIME)

Stacks (STX)

Vector Reserve (VEC)

Disclaimer: None of this is financial advice. This is just one (not very smart) guy’s opinion and taking any immediate action based on this newsletter would be a very silly thing to do.

All words contained within this newsletter are my opinions and mine alone. You should do your own research and have the wherewithal (and self-respect) to make your own decisions independently.